-

23-09-2016, 10:00 PM

#2771

Originally Posted by BlackPeter

Interesting - even really bad events (like WWII) didn't hit the DOW too hard. Depending on what MA you use - the time from 1932 to 1965 was basically all bullish (of course with some corrections in between). Have a play with the chart:

http://www.macrotrends.net/1319/dow-...storical-chart

Thanks for posting the link to the chart Black Peter. Very interesting.

-

24-09-2016, 11:11 AM

#2772

Europe Wall St wiped off half of the preceeding day's rally on Friday.

Hmmm...A "grey" Monday...methinks

-

24-09-2016, 11:22 AM

#2773

Last edited by skid; 24-09-2016 at 11:25 AM.

-

27-09-2016, 05:24 PM

#2774

Looks like the markets have given their verdict on the first debate to Clinton...dow futures added 100+ points since the close of debate.

-

28-09-2016, 10:18 AM

#2775

So atm the things to watch out for are a Trump victory or Fed raising interest rates

-

28-09-2016, 12:00 PM

#2776

Member

Originally Posted by skid

So atm the things to watch out for are a Trump victory or Fed raising interest rates

Also:

European banking sector (Deutsche, Monte Paschi etc)

Still a slow burn risk in China of Deval over time.

-

29-09-2016, 01:45 PM

#2777

Member

-

29-09-2016, 02:38 PM

#2778

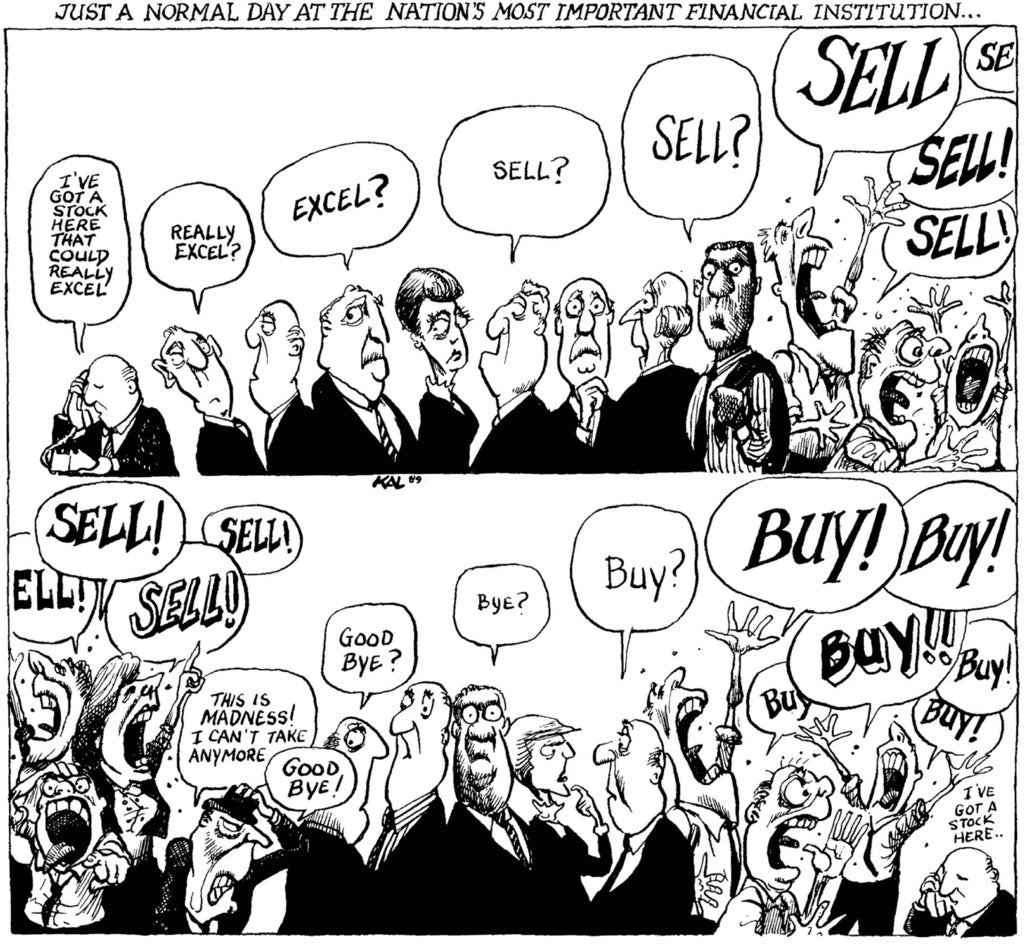

An Encycopedia of what influences the sharemarket in one cartoon???

It's been recycled on ST and other Media over the years...It's still my favourite gem

Last edited by Hoop; 29-09-2016 at 02:40 PM.

-

30-09-2016, 10:11 AM

#2779

Originally Posted by Mush

Also:

European banking sector (Deutsche, Monte Paschi etc)

Still a slow burn risk in China of Deval over time.

You were right to add that---Huge banks in trouble are scary--No one is exempt from collateral damage these days but any opinions on how else we would be affected-or insulated?

-

30-09-2016, 12:51 PM

#2780

Member

Originally Posted by skid

You were right to add that---Huge banks in trouble are scary--No one is exempt from collateral damage these days but any opinions on how else we would be affected-or insulated?

Well skid, all I can do is refer you to this graph that the IMF produced about the most systemic bank Globally.

Attachment 8336

If DB or any of its counter-parties encounter difficulties or bankruptcy, there would be widespread contagion. Even more so than what occurred in 08'

Reports out from Bloomberg yesterday stating that some Hedgies have reduced excess collateral with DB, which signals reduced confidence. SP decline triggered a selloff in Euro/US financial stocks which brought most indicies down with it. Gold and Bonds were bid due to the risk off flight to safety/quality.

Might be time to start increasing the cash holdings (not with Deutsche).

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Bookmarks