-

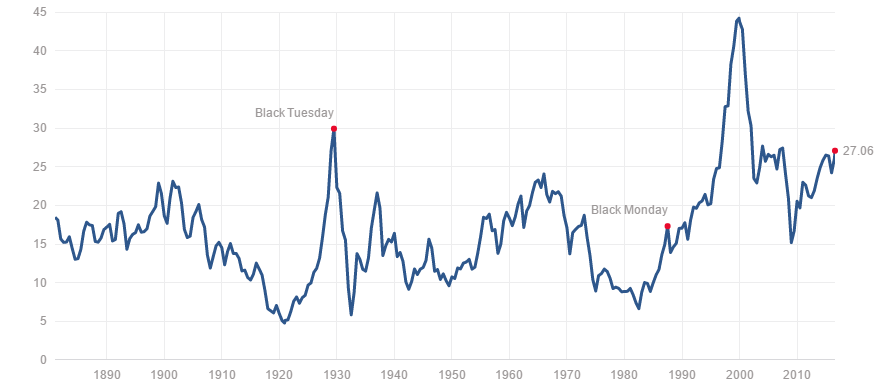

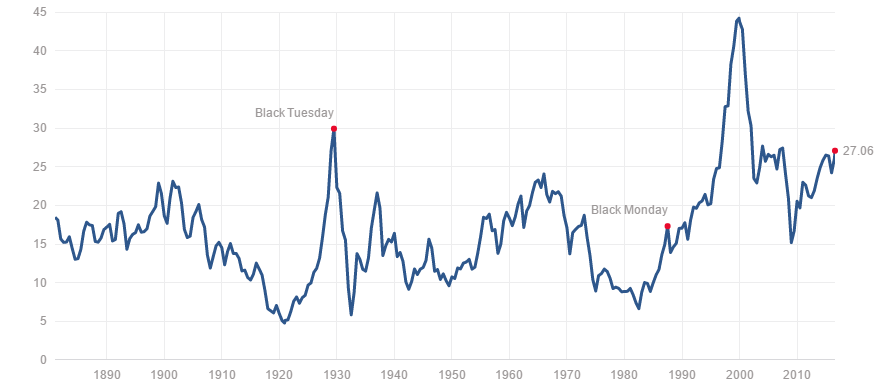

This secular bear market cycle has been very unusual according to its hypothesis....The main obvious point is it's CAPE indicator being reluctant to oscillate down towards 10 as it should be doing..

I've spent some time lately on trying to figure out why the today's market (secular Bear) is so reluctant to "do its natural thing" and cycle back down to <10 in its normal (historic trend) oscillating fashion...Obviously Central Bank has a part to play in the todays world but secular movements are usually trader behavioural and not overly affected by business or economic behavioural scenarios..In other words when there is a secular Bear market cycle in progress (as it has been on Wall St since the year 2000), the very long term falling PE trend is not due to deteriorating economic conditions but due to Investors attitudes changing in wanting better value for their money invested..They as a herd have become more fussy.

So why in his today's world with a secular bear market cycle in progress do we have an unusually very high PE, market earnings uncertainty, investor anxiety, and a lack of investor sense in wanting better value for their money??

An Article written on Seeking Alpha by Lawrence Fuller seemed just another one of these doomsday articles with dramatic headlines SELL EVERYTHING!..I nearly didn't read it.

Writing about crashes during an exhilarating Equity boom party is analyst suicide...Sticking ones reputation on the line is usually only done when ones reputation is not that good to start with...It doesn't matter how fundamentally overvalued the market is..if all the market participants are exuberant and making money they will not see the market as overvalued and will present any evidence they can find not matter have scarce to justify their reasoning..they post it and others find it..so with most market participants having the same reasoning, it is mass self perpetuating justification that the market is in their eyes not overvalued and the market will keep on rising ..nearly everyone agrees, the market is making record highs, so it must be true, so lets us crucify anyone who disagrees with us ..because... how dare they!!! try to destroy our nice financial investments way of life with their "unfounded" pessimism..

So back to this Article written by Lawrence Fuller who says sell everything a day after Wall St reaches another record breaking high..Do read the comments below as some people are cautious (comments longer than the article

He basically mentions ....

Individual and institutional investors have been forced to go from money markets to bonds to high-yield bonds to high dividend-paying stocks with ever- increasing levels of risk to achieve their income requirements. The potential for downside is seemingly irrelevant....which seems to answer my question above why investors are not investing for value as they should be..

Moral Hazard

I think that while all of these fundamental issues are major concerns, what worries this elite group of investment minds even more is the issue of moral hazard. There is a lack of incentive for an investor to guard against risk, because he believes that he is being protected from any adverse consequences. In this instance the protector is our Federal Reserve....

.........It is clear that central banks around the world, led by the Federal Reserve, have borrowed from the future, in terms of forward market returns, in hopes of presenting a better today...........

......This is how moral hazard leads to reckless behavior, which ultimately results in bubbles. It has happened over and over again, and this time is no different. The smartest investment minds know this, which is why they are so sternly warning all of us.

Hmmm this time no different...Question:- Have we seen another secular bear market cycle act strangely but similar to the 2000 to now Secular Bear Cycle?..The 135 year S&P500 Shiller PE chart below shows 1929 - 1950 with a similar abnormal peak with following disruptions to the secular cycle oscillation...

Being very basic and excluding all noise (FED QE and all) one can see a theme between the two periods...Both 1929 & 2000 had massive bubbles that burst creating huge financial destruction, a few years later the Great Depression 1932 -35 and the Great Recession 2008-2009 happened...

With an eye on Market physics, the chart below shows the force of the bubble bursting (1929/2000) followed by disruption to the market causing volatile ripples (aftershocks) of fundamental over-correcting/ under-correcting for years until the market finally settled down back again into it's natural ordered rhythm (cyclic oscillation) again..

Similar type of physics to that of a major earthquakes and the following aftershocks, lasting until the pressures are finally equalised.

The Future?..from the chart above the longer term looks bleak..Like death and taxes PE of 10 (Shiller) will happen at some stage in the future (ending of the secular bear cycle)

Last edited by Hoop; 14-08-2016 at 01:42 PM.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks