-

Junior Member

Last edited by jke_brown; 07-03-2008 at 10:40 PM.

-

Originally Posted by jke_brown

What other methods available to do similar valuation?

Hold on! I wouldn't give up on ROE just yet.

I stand by everything I said about 'the market' reducing your return to well below ROE from an investor perspective by bidding up the price of shares to more than they are 'nominally worth', thus reducing your return for any new shares you buy 'on market'.

But there is still one thing you can do with ROE to 'beat the market'. You have to look for a company with high ROE that does not pay all of its income out as dividends. Why? Because if they can.

1/ Retain some shareholder equity AND

2/ invest that new equity at an historic high rate

(NOTE: these are two pretty big 'ifs')

then the effect of that new bit of equity is often *not* arbitraged away by Mr Market, if you consider a long term time horizon. This is exactly Warren Buffett's strategy as espoused by Mary Buffett.

Effectively Warren considers buying a company on his ten year time horizon, as buying a (roughly) fixed rate of return investment (if you select your company carefully) with what Warren terms an 'expanding coupon' caused by the 'new retained earnings' growing the incrementally expanding business at well above treasury bond rates.

That means that 'high ROE' is not a sufficient criterion for the likes of Warren to make an investment. Warren also requires the company he is considering to be able to retain some of that ROE and invest it wisely. The general market will very likely steer clear of bidding up these investments because in a classical sense this can involve buying a share with a very high PE ratio, which with a one or two year time horizon looks hard to justify. To the likes of Warren however, such an investment can make perfect sense.

SNOOPY

Last edited by Snoopy; 14-03-2008 at 09:29 PM.

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

-

Junior Member

Originally Posted by Snoopy

1/ Retain some shareholder equity AND

2/ invest that new equity at an historic high rate

SNOOPY

good point. lets look at retained earnings. so how do you know if the company is using that retained earnings to make higher return at a historic high rate?

Lets look at dividend paid by telecom nz from 2002 to 2007. during that period total EPS was $3.038 (from my table above)

From that $1.975 was paid in dividend. (from http://www.telecom.co.nz/content/0,8...,00.html?nv=sd)

So telecom nz retained $1.063. During that period share price moved from $4.66 to $4.47.

gain of -0.19 dollars

so assuming all of the retained equity used increase earnings.

return percentage= (-0.19/1.063)*100= -17.87%

But looking at dividend payments and earning per share over the same period.

So dividend return = dividend/eps = 1.975/3.038= 65%

This value seems very high. I am sure I did the calculation correct. So Telecom nz has outstanding dividend return over the same period but negative growth from retained equity.

Originally Posted by Snoopy

with a one or two year time horizon looks hard to justifySNOOPY

this make sense as investors who were not in for the long term didn’t get the high dividend return.

Snoopy, how can one relate ROE to the share price ('nominally worth') mathematically?

As you say market will “bidding up the price of shares to more than they are 'nominally worth', thus reducing your return for any new shares you buy 'on market'

In 2007.

Dollar equity in telecom nz is creating 26c in return.

Dollar equity invested in ASB bank term deposit is crating 8.5c in return.

Dollar invested in the bank has a fixed value, where as dollar equity in telecom nz has a “variable value” due to market dynamics.

My previous post attempted to calculate the fair value, is that accurate?

Most of Warrens concepts like competitive advantage etc are easy to apply but in terms of calculating the nominal value I haven’t found an appropriate equation/method by him.

Last edited by jke_brown; 16-03-2008 at 04:06 PM.

-

Originally Posted by jke_brown

good point. lets look at retained earnings. so how do you know if the company is using that retained earnings to make higher return at a historic high rate?

Lets look at dividend paid by telecom nz from 2002 to 2007. during that period total EPS was $3.038 (from my table above)

From that $1.975 was paid in dividend. (from http://www.telecom.co.nz/content/0,8...,00.html?nv=sd)

So telecom nz retained $1.063. During that period share price moved from $4.66 to $4.47.

gain of -0.19 dollars

so assuming all of the retained equity used increase earnings.

return percentage= (-0.19/1.063)*100= -17.87%

We are talking cross purposes here Jackie. What you have calculated out is 'earnings' from an 'investor perspective'. This is largely uncorrelated with retained earnings from a 'company perspective', which is what is important for company performance.

But looking at dividend payments and earning per share over the same period.

Yes that is what you should be doing. We are back on the same wavelength.

So dividend return = dividend/eps = 1.975/3.038= 65%

This value seems very high. I am sure I did the calculation correct.

I don't think you have included the recent capital return per share. That's because it wasn't on the dividend table because a capital return is not a dividend!

If you include that, the percentage profit paid out will rise to even higher than 65%. But I'm not sure why you consider that high. Telecom have a stated policy of paying out some 90% of earnings as dividends.

BTW....

Retained Earnings = Earnings Per Share - Dividends Per Share

So Telecom nz has outstanding dividend return over the same period

Yes

but negative growth from retained equity.

You can't say that because you haven't worked out what the retained equity was over five years yet. The fact that the share price declined over five years is not relevant to the calculation.

Snoopy, how can one relate ROE to the share price ('nominally worth') mathematically?

Most of Warrens concepts like competitive advantage etc are easy to apply but in terms of calculating the nominal value I havenít found an appropriate equation/method by him.

You probably need to get hold of one of the Mary Buffett books on Warren's methods. I think the latest is "The New Buffettology."

Suffice to say, briefly, that if a company pays out all of their earnings as dividends then ROE and share price are virtually unrelated. But if the company saves all of their earnings and reinvests them back into the company then you will find quite a strong correleation between ROE and share price. Provided that is the reinvestment program is successful!

My previous post attempted to calculate the fair value, is that accurate?

You mean the Ben Graham formula? Yes it is accurate up to a point, depending on how well you agree with the somewhat arbitrary way Ben calculates what the PE 'should be'. I think it is fair to say that Telecom is worth at least what that Ben Graham formula tells you it is worth.

SNOOPY

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

-

Originally Posted by jke_brown

Snoopy I guess the next thing to work out is the intrinsic value.

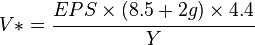

The Graham formula proposes to calculate a company’s intrinsic value V* as:

<snip>

To apply this approach to a buy-sell decision, each company’s relative Graham value (RGV) can be determined by dividing the stock’s intrinsic value V* by its current price P:

An RGV of less than one indicates an overvalued stock and should not be bought, while an RGV of greater than one indicates an undervalued stock and should be bought.

I am not sure how accurate this method is, but I guess it gives a relative valuation that one can compare against the share price and ROE.

I want to say something on the Ben Graham formula , even though it is tangential to the topic of this thread, before I move on.

If you are looking for some share valuation formula where you can stick in some values, crank the handle and get out an 'accurate value' at the other end then I think you will end up disappointed. Any formula based on historical inputs will only give a meaningful answer if those historical numbers you are feeding into it have meaning today and in the future.

In the case of Telecom the industry rules have changed (thanks to the government unbundling announcements). We now have the retail/wholesale 'split' to deal with. Furthermore the way Telecom operates their business model units has changed as well. Telecom have 'repackaged' their businesses into customer focussed 'Consumer' and 'Business' units. The old 'technology packaged' mobile, local service, calling and Broadband/Internet business units are no more (for reporting purposes). Off hand I cannot think of a more radical change for any company I have been a shareholder of, over such a short period of time. Whether the historic Telecom results of even five years ago have any meaning in today's terms is debatable.

Moving to specifics the 'V' value of over 13 you have calculated for FY2007 derives from using an 'eps' figure of $1.58 which includes the one off profit from the Yellow Pages sale. This result while 'accurate' (which means you made no obvious mistakes in the calculation) is also meaningless. That's because the Yellow pages division can only be sold once and the effect of that sale has already been reflected in the share price. (You should have used the adjusted net earnings of $955m instead.) What you have calculated Jackie, is that Telecom is an absolute steal (having an RGV of 3) provided they can sell the Yellow Pages Group again this financial year. A true statement, but one that is of no use to us as investors looking forwards.

Turning to the mechanics of Ben Grahams formula, the core of what Ben is doing is taking 'earnings per share', multplying that number by a predetermined 'Price Earnings Ratio' of 10.1 (calculated by using a typical PE ratio for zero growth, incrementally increased to allow for what real growth the company has demonstrated in the past).

Earnings x Price/Earnings = Price

That is where your valuation (V) share price comes from. Personally I think this formula will underestimate the value of a utility share quite seriously. I think that when earnings from Telecom stabalise (whenever that might be) it should trade in a PE of around 15, given the very strong market position the company has. Grahams formula does not allow for different PEs across different industries.

The formula then tweaks the above result by recognising that valuations are also affected by interest rates. Thus the PE result is 'scaled' by a factor to take this into account by dividing the base timeframe 'long term interest rates' by today's timeframe 'long term interest rates' of comparable quality. If todays long term interest rates are substantially higher than the base case long term interest rates then the value of the PE, and consequently the shares themselves, is proportionately reduced.

The problem we face by using this formula in New Zealand is that it was set up by Graham in the US, for US markets. I notice Jackie that you have replaced the "US base case rate" of 4.4% by

"the average yield of high-grade corporate bonds in 2007= 8.61%".

I do not believe that is a valid substitution, because it is not obviously an historical base case average, like the 4.4 was. However you have divided into that 8.61%

"the current yield on AAA corporate bonds"

That is effectively exactly the same thing. Were you not suspicious when the numbers were virtually identical? Any number divided by itself is one.

So really for 'V' in your spreadsheet you have gone back to Ben's original formula

Price = Earnings x Price/Earnings

or as Ben writes it

Price = Earnings x (8.5+2g)

where g=0.08 (8%)

On the subject of adjusted earnings for Telecom, you may wish to cross reference the work I have already done on the subject.

http://forum.sharechat.co.nz/showthread.php?t=192

SNOOPY

Last edited by Snoopy; 16-03-2008 at 10:29 PM.

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks