-

27-01-2014, 06:34 PM

#2421

Originally Posted by elZorro

I was having a look at the GDP/capita data for NZ and Aussie. There are other benchmarks, but this is a common one. We kept our trend with Aussie until 2008, and then we had a big problem for a few years. Now it's starting to recover, but the US$ GDP figures (note the colours, two ranges) are a long way different. $28,000 for us, $38,000 for Aussie.

So lets look at this then - http://blogs.wsj.com/economics/2013/...g-or-swimming/ read it.

I wonder what this means - http://tvnz.co.nz/business-news/nz-d...aussie-5810297 EZ?

BTW I love Cunliffe $60 a week for new babies bribe - NOT. http://www.nzherald.co.nz/business/n...ectid=11192646That's going to cost the workers who generate cash via tax plenty of money.

Buying votes again. How much will Labout cost us this time if they get in again.

-

27-01-2014, 06:42 PM

#2422

Originally Posted by westerly

Cussie, Do you work on the principle if you say something often enough it will become fact?

The NZ superannuation fund established by Labour has shown an 9.57% return since inception and now stands at $25.2 billion. Incidently National stopped contributions but still holds thier hands out for tax.

Since John Key was elected Govt borrowing averages $27 million per day and is now over $60 billion

In 2007 Govt debt was 17.45% of GDP It is now 36%

Westerly

Wow, so since John Key was elected Govt borrowing averages $27 million per day and is now over $60 billion. Lot of money Westerly, lets now go the the current account balance again and look at those John Key years.

http://www.rbnz.govt.nz/statistics/key_graphs/current_account/

Wow again, looks like John Key knows how to make more money than he borrows and knows what he he doing. Why was Cullen so bad at it.

The NZ superannuation fund would be better off by 8.8 million if Cullen had not lost 8.8 million would it not Westerly? Easy to understand that one would think.

Thanks for helping me out Westerly.

-

27-01-2014, 06:42 PM

#2423

-

27-01-2014, 06:45 PM

#2424

Key is a serious contender Key is a serious contender

This sums it up for me from Rodney Hide beautifully for me.

One of the more common and basic mistakes to make in politics is to underestimate your opponent. It's an easy thing to do. Your opponents are doing it all wrong and so must be either stupid or crooked and perhaps both.

Your team readily agrees and the trap is easy to fall into. And so it is with Labour and John Key.

Labour continues to dismiss Key as a political lightweight who would sell his own mother, in Labour leader David Cunliffe's words.

They overlook that Key toppled Labour's best and strongest leader, has seen off Phil Goff and David Shearer, and who Cunliffe has yet to dent. That's no political lightweight.

Labour has wrongly dismissed Key's politics as "smile and wave" when he has, in fact, led the country through the dark days of the Pike River tragedy and the Canterbury earthquakes.

He has simultaneously overseen our transition through the global financial crisis to "rock-star" economic status.

Labour pooh-poohed Key's credentials in foreign policy. He now has David Cameron's number on speed dial.

Previous New Zealand prime ministers were ecstatic for our future trade prospects with a two-minute "pull aside" at a formal meeting. Key plays golf with the President of the United States on his holidays.

Key, with no fuss, has turned over 13 of his own MPs in just two years to refresh the party. That's rare political power and skill.

Cunliffe, meanwhile, is stuck with the team that didn't want him and which includes ministers from the 1980s plus the party's two previous leaders.

Key has had none of the scandal that has mired previous administrations. He has quietly and expeditiously dealt with erring ministers before the Opposition and public were even aware there was a problem.

Key has honed his ability to communicate the Government's position in a way that we can appreciate and understand, even when we don't agree with it.

John Campbell bullied Key to front up to explain the controversial GCSB legislation. Key turned up to TV3 and took over his show. Key knew what he was talking about. Campbell didn't.

It was stunning television and an extraordinary display of political and media skill. Helen Clark was good but not that good. She was reduced to calling Campbell a "sanctimonious little creep".

Kiwis are overwhelmingly positive about the year ahead. In the last Colmar Brunton Poll, 57 per cent of New Zealanders thought they would be better off in 12 months.

Only 24 per cent thought they would be worse off. The positives outnumber the negatives two-to-one.

In the comparable poll in the same part of the election cycle for Helen Clark, only 32 per cent thought they would be better off and 40 per cent thought they would be worse off. There were more negatives than positives.

It is historically difficult to topple a government with voters overwhelmingly thinking they will be better off. Voters thinking positively don't want to rock the boat. That would be putting their own prosperity at risk.

Clark was a very popular prime minister. Her average in the preferred prime minister stakes was almost 2 times her predecessor Jim Bolger's. That's an extraordinary achievement. But Key's is even more extraordinary. His average is fully 10 percentage points above Clark's.

That's a 25 per cent advantage.

Labour has taken to calling Key lucky. They persist in underestimating him. It's like they just have to wait until his luck runs out.

I got to work with Key. It's not luck. This is a man who is smart, who works hard and who understands people.

Of course, Labour can beat him. On performance that shouldn't be possible. But it's MMP. It's looking a very close election.

But Labour won't beat him by underestimating him. One thing is sure: Key won't be underestimating Cunliffe or just how tough a job he has this election.

-

27-01-2014, 07:16 PM

#2425

Originally Posted by Cuzzie

Thanks EZ and this is what it states.

"The Balance of Payments statements set out a country’s transactions with the rest of the world. The current account balance is the sum of the balances of trade in goods and services, current transfers, and investment income. More simply, the current account measures what a country saves minus what it spends or invests. The graph shows that since 1990, New Zealand has been a net borrower. Thus, the current account deficit has reflected the amounts of other countries’ savings that New Zealand has had to borrow, in order to finance spending. The last time that New Zealand was a net saver — that is, had a current account surplus — was 1973." Thanks for pointing me in that direction EZ, your making my replies oh too easy.

So if Cullen & Clark did so well during their tender as you are always going on about, they must of spent and incredible amount more money than I thought. Thanks for pointing this out too EZ. As stated, "More simply, the current account measures what a country saves minus what it spends or invests."

I'll spell that out to you EZ, when we take off the spending from the last three terms by Labour per year from the amount of earnings plus savings we get a final figure. Maybe if Cullen had not gambled our money away in the NZ Super Fund they would of been $880.75 million better off. Here is a link to hopeless Cullen burning 8.8 million of the NZ public money. http://www.stuff.co.nz/business/650238 Looks like you will have to knock the stuff.co website too now and state they meant to say something else too. For Labour that is the worst ever since records began and the reason 70% of NZers voted Helen Clark and her mad men/women out of Parliament.I've come to the conclusion that you need to do quite a bit of fact altering EZ, that must be a lefty thing to and is total foreign to me.

Cuzzie, slow down, I have to answer this first. Here is some info about the current account from Wikipedia, a great topic called Economy of New Zealand.

Liberalisation[edit]

Since 1984, the New Zealand government has undertaken major economic restructuring (known first as Rogernomics and then Ruthanasia), moving an agrarian economy dependent on concessionary British market access toward a more industrialised, free-market economy that can compete globally. This growth has boosted real incomes, broadened and deepened the technological capabilities of the industrial sector, and contained inflationary pressures. Inflation remains among the lowest in the industrial world. Per-capita GDP has been moving up towards the levels of the big West European economies since the trough in 1990, but the gap remains significant. New Zealand's heavy dependence on trade leaves its growth prospects vulnerable to economic performance in Asia, Europe, and the United States.

Between 1984 and 1999, a number of measures of New Zealand's economic and social capital showed a steady decline: the youth suicide rate grew sharply into one of the highest in the developed world; [17] the number of food banks increased dramatically; [18] marked increases in violent and other crime were observed; [19] the number of New Zealanders estimated to be living in poverty grew by at least 35% between 1989 and 1992; [20] and health care was especially hard-hit, leading to a significant deterioration in health standards among working and middle-class people. [21]

Between 1985 and 1992, New Zealand's economy grew by 4.7% during the same period in which the average OECD nation grew by 28.2%. [22] From 1984 to 1993 inflation averaged 9% per year, New Zealand's credit rating dropped twice, and foreign debt quadrupled. [20] Between 1986 and 1993, the unemployment rate rose from 3.6% to 11%. [23]

Outlook and challenges[edit]

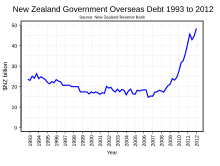

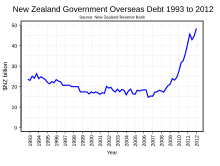

New Zealand net overseas debt 1993–2012

New Zealand government overseas debt 1990–2012

The New Zealand economy has recently been perceived as successful. However, the generally positive outlook includes some challenges. New Zealand income levels, which used to be above much of Western Europe prior to the deep crisis of the 1970s, have never recovered in relative terms. For instance, the New Zealand nominal GDP per capita is about 80% that of the United States. Income inequality has increased greatly, implying that significant portions of the population have quite modest incomes. Further, New Zealand has a very large current account deficit of 8–9% of GDP. Despite this, its public debt stands at 33.7% (2011 est.) [24] of the total GDP, which is small compared to many developed nations. However, between 1984 and 2006, net foreign debt increased 11-fold, to NZ$182 billion, NZ$45,000 for each person. [12]

The combination of a modest public debt and a large net foreign debt reflects that most of the net foreign debt is held by the private sector. At 31 June 2012, gross foreign debt was NZ$256.4 billion, or 125.3% of GDP. [25] At 31 March 2012, net foreign debt was NZ$141.65 billion or 104.4% of GDP. [26]

New Zealand's persistent current-account deficits have two main causes. The first is that earnings from agricultural exports and tourism have failed to cover the imports of advanced manufactured goods and other imports (such as imported fuels) required to sustain the New Zealand economy. Secondly, there has been an investment income imbalance or net outflow for debt-servicing of external loans. The proportion of the current account deficit that is attributable to the investment income imbalance (a net outflow to the Australian-owned banking sector) grew from one third in 1997 to roughly 70% in 2008.[27]

I hope this puts it clearly Cuzzie: yes, we have a high current account deficit, but it is mostly private debt (farms, houses, equipment), and if we had our own banks doing most of the lending, those interest profits wouldn't be going offshore at least. The last three-term Labour government took in more cash than they spent each year, and applied free cash to paying off government loans. They left the market to handle its own borrowing of course, and one of the factors that caught everyone out was the increasing cost of energy, along with lowish commodity prices for timber and farming outputs.

Westerly was right, John Key's govt has brought overseas borrowing up sharply, as shown in this graph, which is not up to date. Note that it started after the GFC, when they were in office. Because he is also selling off parts of state assets, tax income has been down, and costs are steady, Solid Energy has been a disaster under their watch etc, the net value of Crown assets will be dropping, or not improving as well as it should.

Last edited by elZorro; 27-01-2014 at 07:31 PM.

-

27-01-2014, 08:36 PM

#2426

Originally Posted by belgarion

He's making all National supporters look sycophantic and stupid.

Very astute. To be able to judge many thousands of NZers by one person's brief comments is a rare talent indeed. Well done.

-

27-01-2014, 09:10 PM

#2427

Cuzzie, I have read a Treasury speech in the meantime (2006) which implied the public sector is about 1/3 of the country's economy. So Labour efficiently managed a whole 1/3rd of NZ's economy and paid off some long-term debt, for nine years. The other 2/3rds of the economy, the private sector, spent more than they earned. Under National, both parts of the economy have been overspending.

I had a look at Labour's State of the Nation speech. The rebates for our youngest citizens was the keynote offering, and I wasn't so sure about it at first. But it's not a lot of cash anyway, because it's targeted. A fair bit will come back as taxes, fuel excise, GST. The policy will set up more businesses and jobs, unlike National's education training idea. The crowd that was there liked the R&D tax credits being mentioned amongst other policies, but they especially cheered for a Capital Gains Tax.

Remember we (NZ) are almost on our own in not having a CGT. For most of us it won't affect us a great deal. When it does, we'll still have most of our capital gain to keep. But the movement of capital into more profitable areas, instead of 'lazy' areas like property, and property related businesses that don't employ many people - that's what will increase GDP per capita, employment, and the tax base, and make it easier for the govt to provide good infrastructure and services in the future.

These two policies were mentioned together. I'm sure there was a good reason for that, they are complementary. I sure hope Labour gets a chance to get going on this in 2014.

-

27-01-2014, 10:04 PM

#2428

Originally Posted by elZorro

Cuzzie, slow down, I have to answer this first. Here is some info about the current account from Wikipedia, a great topic called Economy of New Zealand.

I hope this puts it clearly Cuzzie: yes, we have a high current account deficit, but it is mostly private debt (farms, houses, equipment), and if we had our own banks doing most of the lending, those interest profits wouldn't be going offshore at least. The last three-term Labour government took in more cash than they spent each year, and applied free cash to paying off government loans. They left the market to handle its own borrowing of course, and one of the factors that caught everyone out was the increasing cost of energy, along with lowish commodity prices for timber and farming outputs.

Westerly was right, John Key's govt has brought overseas borrowing up sharply, as shown in this graph, which is not up to date. Note that it started after the GFC, when they were in office. Because he is also selling off parts of state assets, tax income has been down, and costs are steady, Solid Energy has been a disaster under their watch etc, the net value of Crown assets will be dropping, or not improving as well as it should.

EZ dig as deep as you like but the state of the current account balance will always come back to spending and earning totals. That is the total for each year by each Govt. Beat around the bush all you want, at the end result will always be the http://www.rbnz.govt.nz/statistics/k...rrent_account/ That graph is the final figures.

You say Key borrowed so much more that Labour and Labour made so much more than National. That only makes it worse for Labour and better for National because Nationals current accounts balance is the best it has been for many years and with all that borrowing your telling us about, what ever Key has done worked and worked well. On the other hand you tell us that Labour made plenty of money during their time, where is it. We know Cullen found extra millions at one point tucked away. Even those extra millions did not help the worst results during the Laboured years for any financial year. Massive deficit by Labour anyway you candy-coat it EZ, massive.

I hope this helps you understand EZ.

-

27-01-2014, 10:05 PM

#2429

Originally Posted by belgarion

One notes you do nothing for your party by letting idiots rave on.

And your excuse is .......

belboy, I understand that you backing Dot.com has been a massive failure on your part and I feel your pain when calling me a idiot. I told you it would end in tears and it did. Some might call that a good call, that is unless you are the idiot and you are. I know it's not completely over yet and hope it goes on for a while. A slow painful death would be nice.

Sorry belgarion but it is all there in black & white. You have plenty of reasons to call me an idiot if I have just showcased you as one.

Last edited by Cuzzie; 28-01-2014 at 09:52 AM.

-

27-01-2014, 10:39 PM

#2430

Originally Posted by belgarion

One notes you do nothing for your party by letting idiots rave on.

I do not have a party. Nor do I let anyone, idiots or not, rave on. Nobody seeks my permission to comment here or anywhere else.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks