-

Junior Member

How to calculate Return on Equity? How to calculate Return on Equity?

I have been trying to calculate ROE. I am getting confused with various balance sheet items in annual reports. so ROE is…

>>>>>>>

ROE

Return on Equity. An indicator of corporate profitability, widely used by investors as a measure of how a company is using its money. There are two ways of calculating ROE: the traditional formula and the DuPont formula. The traditional approach divides the company's net profit after taxes for the past 12 months by stockholders' equity (adjusted for stock splits). But this fails to account for the effect of borrowed funds, which can magnify the returns posted by even a poorly managed company. An alternative approach, developed by the DuPont Corporation, links return on investment (ROI) to financial leverage (use of debt).

Traditional Formula:

ROE = Net Profit After Taxes ÷ Stockholders' Equity

DuPont Formula:

ROE = ROI x Equity Multiplier

ROE = (Net Profit After Taxes ÷ Total Assets) x (Total Assets ÷ Stockholders' Equity)

For example, using the traditional formula, a company with $18,000 in net profit after taxes and $45,000 in stockholders' equity would have an ROE of 40%. The DuPont formula takes the analysis one step further by factoring in the contribution of borrowed funds. Using the previous example, if the company has total assets of $100,000, then $55,000 of the company's capital is supplied by creditors and its equity multiplier is 2.22.

ROE = ($18,000 ÷ $100,000) x ($100,000 ÷ $45,000)

ROE = 18% x 2.22

ROE = 40%

>>>>>>>>>>>>>>

ok. so lets take a real life example. We look at Telecom New Zealand 2007 annual report.

http://annualreport07.telecom.co.nz/...eport-2007.pdf

I get these figures from pages 31 and 32.

Net earnings /(loss) attributable to shareholders =3024

Total assets =8276

Total equity attributable to equity holders of the company=3598

ROE=(3024/8276) x (8276/3598) =0.840%

Is this calculation correct?

-

Dupont Formula isn't much in vogue but I think the Return on Equity version is easier to work with if expressed as:

(Net Income / Sales) * (Sales / Total Assets) * (Total Assets / Avg Equity)

So based on your numbers above (Sales I think are $5.562b) but adjusting out extraordinary movements in earnings (Earnings back down to $955m)...

=(955/5562) * (5562m/8176) * (8276/3604)

=0.1717 * 0.6803 * 2.296

=0.2681

=26.81%

Personally, I'd just go for ROE as Net Income / Avg Equity (or more simply End of Year Equity)...

= (955/3604)

=0.265

=26.5%

In this example they are virtually the same in any case. The DuPont measure is injecting a qualitative stance by supposing that high sales margins and high return on assets are attributes that should go hand in hand with high return on equity. Probably works for most arguments but more difficult to apply to a Bank on the asset measure or a large format discount retailers on the sales margin one - you'd want to be comparing against peers rather than other industries and that might make you lose sight of return on equity if other industries provide better prospects.

-

Originally Posted by Halebop

Dupont Formula isn't much in vogue but I think the Return on Equity version is easier to work with if expressed as:

(Net Income / Sales) * (Sales / Total Assets) * (Total Assets / Avg Equity)

So based on your numbers above (Sales I think are $5.562b) but adjusting out extraordinary movements in earnings (Earnings back down to $955m)...

=(955/5562) * (5562m/8176) * (8276/3604)

=0.1717 * 0.6803 * 2.296

=0.2681

=26.81%

Personally, I'd just go for ROE as Net Income / Avg Equity (or more simply End of Year Equity)...

Halebop,

The two formulae you quoted are exactly the same??

The sales & total assets being both a denominator & numerator simply cancel out?

In your example total assets are calculated as $8,176b and then $8,276b. What is the $100m adjustment?

Cheers

Share prices follow earnings....buy EPS growth!!

-

Oops. The $100m was a typo in my spreadsheet transposed to post. Only excuse I can offer is that I was eating squid and typing with one hand.

Du Pont is not intended as a ROE measure, the last part of the equation turns it into an ROE measure but it gets you back to where you should be anyway If the user stuck with a simple ROE calc.

Du Pont is really a qualitative measure used to weed out low margin, high Capex businesses or identify high margin / low capex stars. I suspect without intending to DuPont also created a benchmarking tool because to my mind it is really most effective when measuring peers rather than a grab-bag of targets.

Du Pont alone (without trying to get back to ROE) is (Profit / Sales) * (Sales / net Assets). So I'm not sure if it tells you much of anything useful to compare a low margin / low asset supermaket with a high margin / high asset property company for instance. Particularly on a trending series, I think it is more useful to compare a basket of super market operators or a basket of property companies.

It's one measure though and I suspect not popular for some good reasons. Not least of which is you can't tell what you are seeing from the results - did Assets or Margins contribute most to the outcome? Buffett's simple tenets are much easier by keeping them on separate lines.

-

Originally Posted by jke_brown

I have been trying to calculate ROE. I am getting confused with various balance sheet items in annual reports. so ROE is…

>>>>>>>

ROE

Return on Equity. An indicator of corporate profitability, widely used by investors as a measure of how a company is using its money. There are two ways of calculating ROE: the traditional formula and the DuPont formula. The traditional approach divides the company's net profit after taxes for the past 12 months by stockholders' equity (adjusted for stock splits). But this fails to account for the effect of borrowed funds, which can magnify the returns posted by even a poorly managed company. An alternative approach, developed by the DuPont Corporation, links return on investment (ROI) to financial leverage (use of debt).

Traditional Formula:

ROE = Net Profit After Taxes ÷ Stockholders' Equity

DuPont Formula:

ROE = ROI x Equity Multiplier

ROE = (Net Profit After Taxes ÷ Total Assets) x (Total Assets ÷ Stockholders' Equity)

For example, using the traditional formula, a company with $18,000 in net profit after taxes and $45,000 in stockholders' equity would have an ROE of 40%. The DuPont formula takes the analysis one step further by factoring in the contribution of borrowed funds. Using the previous example, if the company has total assets of $100,000, then $55,000 of the company's capital is supplied by creditors and its equity multiplier is 2.22.

ROE = ($18,000 ÷ $100,000) x ($100,000 ÷ $45,000)

ROE = 18% x 2.22

ROE = 40%

>>>>>>>>>>>>>>

ok. so lets take a real life example. We look at Telecom New Zealand 2007 annual report.

http://annualreport07.telecom.co.nz/...eport-2007.pdf

I get these figures from pages 31 and 32.

Net earnings /(loss) attributable to shareholders =3024

Total assets =8276

Total equity attributable to equity holders of the company=3598

ROE=(3024/8276) x (8276/3598) =0.840%

Is this calculation correct?

Good question Jackie. These buzzword terms are bandied about on this forum often enough and IMO there probably is not enough discussion on demystifying them. Also thanks for your references which makes it clear where you are pulling your data from so it is easy to follow.

On my paper edition of the Telecom 2007 Annual Report 'The net earnings attributable to shareholders' appears on page 29 as $3,024m. Total equity attributable to equity holders of the company is $3,598m.

Using the traditional definition of:

ROE= Net Profit After Taxes ÷ Stockholders' Equity

I get $3,024m/$3,598m = 0.84 which is 84% (when expressed in percentage terms)

Using the Dupont definition, we also work in the 'total assets' as found on page 31 of the annual report ($8,276m)

ROE= ROI x Equity Multiplier

= (Net Profit After Taxes ÷ Total Assets) x (Total Assets ÷ Stockholders' Equity)

= ($3,024/$8,276)x($8,276m/$3,598m)

= (0.3654)x(2.300)

= 0.84 = 84% when expressed in percentage terms

Both formulae give the same answer (which is no surprise), which is the same as your answer Jackie. Well done, you have nailed it!

So why bother with the two different formulae if they both give the same answer?

The Dupont formula makes it clear that the 'Return on Invested Capital' (ROI) is 0.3654, or 36.5%. That is less than the 'Return on Shareholders Equity' (ROE) finally calculated out at 84%. And that shows that a large reason the ROE is so high is because of Telecom's borrowings. The Dupont formula does not give a different answer. It just gives you a better feel for why the answer is the way it is.

Finally, any formula is only as good as the numbers you put into it. That $3,024m profit is made up from the profit from normal operations *plus* the profit made by the 'Yellow Pages' group sale. Once the Yellow pages group is sold it is sold, Telecom cannot sell it again. That is why Halebop has used the 'Adjusted Net Earnings' on page 20 of the annual report of $955m in his calculations, and why he gets a different answer to you. Usually it is the ongoing operational profitability (and by implication 'Ongoing operational ROE') we are interested in.

SNOOPY

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

-

Junior Member

thanks Halebop for your great input while eating squid and snoopy for clearing up the diffrence between "Return on Shareholders Equity" and "Return on Invested Capital"

I worked out ROE for last 7 years.

Code:

2001 2002 2003 2004 2005 2006 2007 Year

643 191 704 775 806 2656 3024 Net profit after taxes

614 670 709 775 806 820 955 Adjusted net earnings

5403 5537 5199 5360 5605 5555 5582 Operating Revenue

7421 7500 7755 8246 8972 6203 8276 Total assets

2003 1328 1776 2617 2612 1062 3604 Total Equity

30.65% 50.45% 39.92% 29.61% 30.86% 77.21% 26.50% ROE (du point)

32.10% 14.38% 39.64% 29.61% 30.86% 250.09% 83.91% ROE

so telecom nz been doing well in terms of ROE over the years? Surely better than having the money in the bank looking at ROE?

Other thing I am not sure about is the dividends. How do I go about including dividends in the formula?

Last edited by jke_brown; 06-03-2008 at 02:04 PM.

-

Originally Posted by jke_brown

I worked out ROE for last 7 years.

Code:

2001 2002 2003 2004 2005 2006 2007 Year

643 191 704 775 806 2656 3024 Net profit after taxes

614 670 709 775 806 820 955 Adjusted net earnings

5403 5537 5199 5360 5605 5555 5582 Operating Revenue

7421 7500 7755 8246 8972 6203 8276 Total assets

2003 1328 1776 2617 2612 1062 3604 Total Equity

30.65% 50.45% 39.92% 29.61% 30.86% 77.21% 26.50% ROE (du point)

32.10% 14.38% 39.64% 29.61% 30.86% 250.09% 83.91% ROE

So telecom nz been doing well in terms of ROE over the years? Surely better than having the money in the bank looking at ROE?

There are a couple of things you need to bear in mind Jackie, that makes the return, from an investor perspective, not as attractive as it might casually appear.

If you buy shares in Telecom you become a shareholder and you get your slice of shareholders equity - that's true. However you cannot buy shareholders equity on its own. You also have to buy your fair share of shareholder debt which is included in the purchase price of the Telecom shares you buy. You have to buy the shareholders equity AND debt, which together add up to the sum of the company assets, as part of one purchase package.

So? you say. That only means I get the Du Pont return instead of the 'classic' ROE return. The Du Pont return may be less than the classic (84% in this case) return, but it is still much better than the bank return, so buying in is still a good deal - right?

I am sorry to inform you that most of those financial types who graze on the sharemarket for a living have figured this out before you. So let's say your Dupont ROE return for Telecom is 26.5%. Let's say our sharemarket punter has their money in the bank at 9%. On paper it looks like an easy swap. Take your money invested at 9% out of the bank. Put your money into Telecom and voilà your income has more than doubled!

In practice you can't more than double your return by doing this. That's because 'the market' ensures that an arbitrage adjustment on the Telecom purchase price exists. Let's say you want to buy $10,000 worth of Telecom. The market will ensure that instead of paying $10,000 for this 'investment package' you will actually pay around:

$10,000 x (26.5%/9%) = $29,444.

Thus even though you are getting 26.5%, you have to pay more than the nominal coupon rate (called 'the market price') to get it. Thus your $10,000 will buy far less shares than you thought reducing your investment yield to 9%, the same as you were getting from the bank.

OK I am simplifying things a bit here. The market does price in risk. An investment in Telecom is seen as riskier than a term deposit. So that means you will get slightly more by way of a Telecom dividend than from interest by investing in the bank. But the point I am making is that the amount 'extra' that you get is actually quite small. You won't get a return of 26% just by buying Telecom shares on market!

Other thing I am not sure about is the dividends. How do I go about including dividends in the formula?

Ah now there is an important question, and there is no one answer.

There is a school of thought that dividends are a bad thing. Why? Because any money paid out in dividends *reduces* shareholder equity. The lower the shareholder equity, for a given ROE, the lower your return is likely to be. That's because:

Total Return= (Shareholder Equity)x(ROE)

And, for a constant ROE, reducing shareholder equity will reduce your return in the future- not a good thing

Either the company will keep the money they earn OR distribute it to you as dividends. But they can't use the same money to pay you a dividend AND build up shareholder equity. The company management has to *choose* what they will do.

If a company can earn a superior return on the equity they retain from normal earnings, than you can get by investing that same money, then (in theory) you do not want them to pay a dividend. But if they can't do that, then paying you the money as a dividend is the best use of the cash they are generating.

SNOOPY

Last edited by Snoopy; 06-03-2008 at 05:44 PM.

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

-

Junior Member

Last edited by jke_brown; 07-03-2008 at 09:40 PM.

-

Originally Posted by jke_brown

What other methods available to do similar valuation?

Hold on! I wouldn't give up on ROE just yet.

I stand by everything I said about 'the market' reducing your return to well below ROE from an investor perspective by bidding up the price of shares to more than they are 'nominally worth', thus reducing your return for any new shares you buy 'on market'.

But there is still one thing you can do with ROE to 'beat the market'. You have to look for a company with high ROE that does not pay all of its income out as dividends. Why? Because if they can.

1/ Retain some shareholder equity AND

2/ invest that new equity at an historic high rate

(NOTE: these are two pretty big 'ifs')

then the effect of that new bit of equity is often *not* arbitraged away by Mr Market, if you consider a long term time horizon. This is exactly Warren Buffett's strategy as espoused by Mary Buffett.

Effectively Warren considers buying a company on his ten year time horizon, as buying a (roughly) fixed rate of return investment (if you select your company carefully) with what Warren terms an 'expanding coupon' caused by the 'new retained earnings' growing the incrementally expanding business at well above treasury bond rates.

That means that 'high ROE' is not a sufficient criterion for the likes of Warren to make an investment. Warren also requires the company he is considering to be able to retain some of that ROE and invest it wisely. The general market will very likely steer clear of bidding up these investments because in a classical sense this can involve buying a share with a very high PE ratio, which with a one or two year time horizon looks hard to justify. To the likes of Warren however, such an investment can make perfect sense.

SNOOPY

Last edited by Snoopy; 14-03-2008 at 08:29 PM.

Watch out for the most persistent and dangerous version of Covid-19: B.S.24/7

-

Junior Member

Originally Posted by Snoopy

1/ Retain some shareholder equity AND

2/ invest that new equity at an historic high rate

SNOOPY

good point. lets look at retained earnings. so how do you know if the company is using that retained earnings to make higher return at a historic high rate?

Lets look at dividend paid by telecom nz from 2002 to 2007. during that period total EPS was $3.038 (from my table above)

From that $1.975 was paid in dividend. (from http://www.telecom.co.nz/content/0,8...,00.html?nv=sd)

So telecom nz retained $1.063. During that period share price moved from $4.66 to $4.47.

gain of -0.19 dollars

so assuming all of the retained equity used increase earnings.

return percentage= (-0.19/1.063)*100= -17.87%

But looking at dividend payments and earning per share over the same period.

So dividend return = dividend/eps = 1.975/3.038= 65%

This value seems very high. I am sure I did the calculation correct. So Telecom nz has outstanding dividend return over the same period but negative growth from retained equity.

Originally Posted by Snoopy

with a one or two year time horizon looks hard to justifySNOOPY

this make sense as investors who were not in for the long term didn’t get the high dividend return.

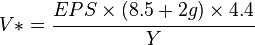

Snoopy, how can one relate ROE to the share price ('nominally worth') mathematically?

As you say market will “bidding up the price of shares to more than they are 'nominally worth', thus reducing your return for any new shares you buy 'on market'

In 2007.

Dollar equity in telecom nz is creating 26c in return.

Dollar equity invested in ASB bank term deposit is crating 8.5c in return.

Dollar invested in the bank has a fixed value, where as dollar equity in telecom nz has a “variable value” due to market dynamics.

My previous post attempted to calculate the fair value, is that accurate?

Most of Warrens concepts like competitive advantage etc are easy to apply but in terms of calculating the nominal value I haven’t found an appropriate equation/method by him.

Last edited by jke_brown; 16-03-2008 at 03:06 PM.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks