-

31-10-2016, 12:49 PM

#1641

Member

Your RAR is very high Your RAR is very high

Originally Posted by humvee

Attachment 8409

I see that 3 people are achieving RAR's of over 20% with more then 800 Loans, Are any of them about on this forum? If so what technique are they useing?

Im on a RAR of 16.89% with well over 1000 loans which I think is fairly good - It most likely would have been higher if I had not got caught up in every single loan the big fraud case early on (10+ loans)

Attachment 8410

Hi Humvee, your RAR is very high for your number of loans. I am struggling to keep mine above 14% - just hit 3000 loans, 16 months so far, 65 write offs. I will be extremely happy if I can hit 15%. The last 6 months my RAR had been between 13.62 and 14.12.

-

31-10-2016, 01:18 PM

#1642

Member

Originally Posted by Cool Bear

Hi Humvee, your RAR is very high for your number of loans. I am struggling to keep mine above 14% - just hit 3000 loans, 16 months so far, 65 write offs. I will be extremely happy if I can hit 15%. The last 6 months my RAR had been between 13.62 and 14.12.

I agree approx 14% seems a good achievable number at present without adding too much risk.

I am hovering around this figure too, it was higher but writeoffs brought it back down.

I might give up chasing high returns and tweak my autolend options for this figure too. It seems a fair return I can live with

-

31-10-2016, 02:03 PM

#1643

Statistical Normality Statistical Normality

Originally Posted by humvee

Looks like a classic statistical chart.

The more loans you have the closer your returns are likely to be to the average (mean? median? I forget the correct term).

Anybody actually have a handle on RAR per risk grade - just curious.

Best Wishes

Paper Tiger

-

31-10-2016, 02:30 PM

#1644

Member

Originally Posted by Paper Tiger

Looks like a classic statistical chart.

The more loans you have the closer your returns are likely to be to the average (mean? median? I forget the correct term).

Anybody actually have a handle on RAR per risk grade - just curious.

Best Wishes

Paper Tiger

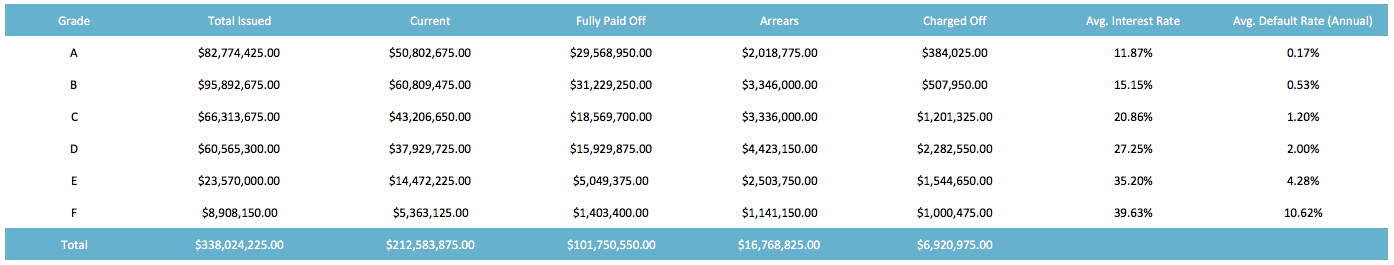

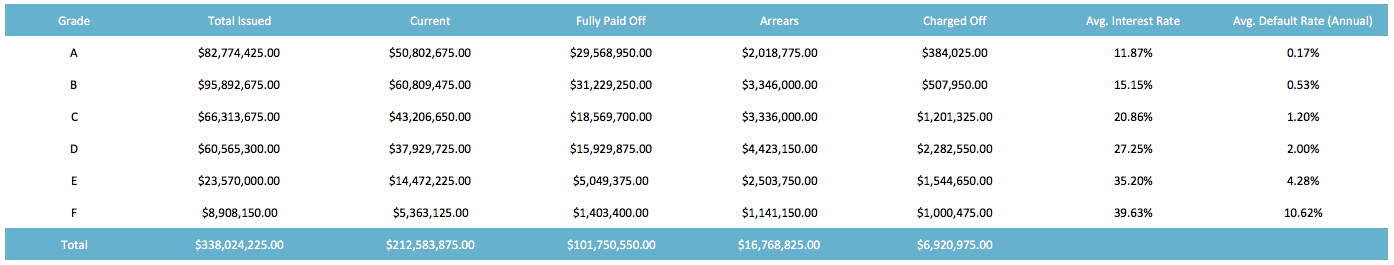

You can get an estimate from their figures below (ave int less ave defaults less a bit of timing difference = RAR) if only their estimated defaults rates are accurate. My estimate so far is that their default rates need to be increased by 50 to 100% to reflect the actual default rate. I guess if you are in it long enough (say 3 to 5 years) and have enough loans, you can work it out based on your loans. Still early days yet!

-

31-10-2016, 02:31 PM

#1645

Member

Their website seems to be down at the moment!

-

31-10-2016, 03:13 PM

#1646

Klumpfisken Klumpfisken

Tak (as the Danes say) - Cool Bear

I chucked those numbers at a spreadsheet and came out with 14.3% overall.

So assuming my assumptions are correctly assumed, then the it looks right.

The alternative is that we have one of those co-incidences.

For each individual grade I have:

A: 10.0%

B: 12.1%

C: 15.3%

D: 18.5%

E: 20.8%

F: 17.6%

Best Wishes

Paper Tiger

-

31-10-2016, 03:19 PM

#1647

Originally Posted by Cool Bear

You can get an estimate from their figures below (ave int less ave defaults less a bit of timing difference = RAR) if only their estimated defaults rates are accurate. My estimate so far is that their default rates need to be increased by 50 to 100% to reflect the actual default rate. I guess if you are in it long enough (say 3 to 5 years) and have enough loans, you can work it out based on your loans. Still early days yet!

Would "churn" or the frequency of rewrites and early repayments affect the actual default rate experienced by an investor. Harmoney may correctly assign the default risk for the life time of a loan in a certain grade. However if your $25 in a loan note, that has not been charged off, is repaid early and then subsequently reinvested, then it again faces the risk of being charged off again.

The annual default rate for loans is an average figure. There are fewer defaults in the latter period of a loan, so frequent early repayments and rewrites I guess would mean that your $25 would be more likely to be invested in the riskier earlier period of a loan.

Last edited by Bjauck; 31-10-2016 at 03:23 PM.

-

31-10-2016, 03:41 PM

#1648

Member

Originally Posted by Bjauck

Would "churn" or the frequency of rewrites and early repayments affect the actual default rate experienced by an investor. Harmoney may correctly assign the default risk for the life time of a loan in a certain grade. However if your $25 in a loan note, that has not been charged off, is repaid early and then subsequently reinvested, then it again faces the risk of being charged off again.

The annual default rate for loans is an average figure. There are fewer defaults in the latter period of a loan, so frequent early repayments and rewrites I guess would mean that your $25 would be more likely to be invested in the riskier earlier period of a loan.

So very true!

Hence my anger at Harmoney promoting rewrites - not only did it use to boost their fees from investors ( but it also resets you into the high risk period that you mention).

BTW I have given up due to the lack of a secondary market and am withdrawing funds as they are repaid.

-

31-10-2016, 04:36 PM

#1649

Investor

If you're that concerned about reinvesting funds from a loan that was paid off early, you should invest in safer grades. Having a loan repaid early is hardly a bad thing.

-

31-10-2016, 08:29 PM

#1650

Member

I agree with Investor, other than the old fees on principal, having your loan paid back early is good for us. And I think it lowers your default rate rather than raise it as you now got a successful loan (in that you got your money back).

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Bookmarks