-

10-09-2015, 01:35 PM

#631

Originally Posted by ratkin

Who said its a bear market? Might just be a bull, climbing that wall of worry.

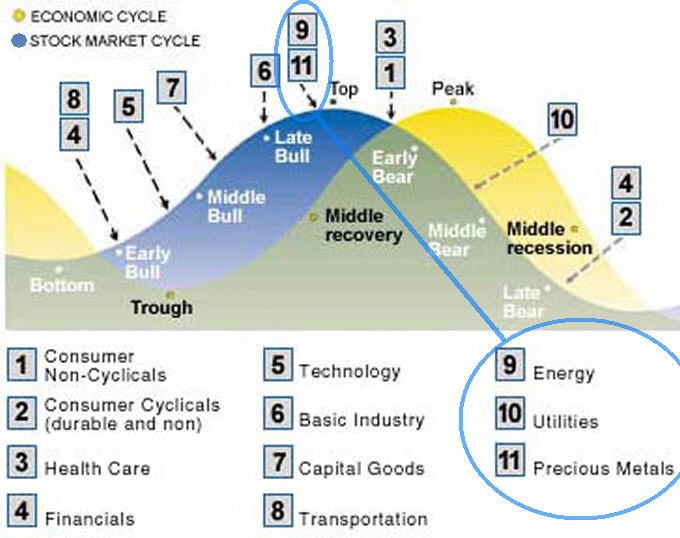

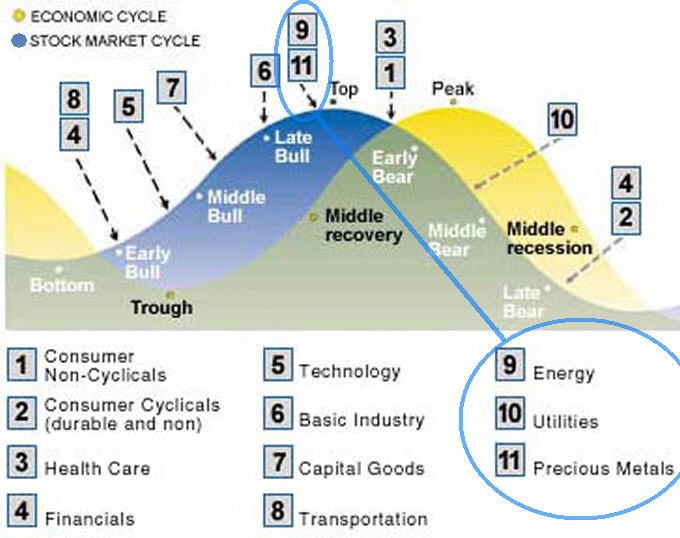

The Wall of Worry period happens during the uptrend in Stage 1 of the new Bull cycle when investors still doubt that the Equity market has recovered as the economy is still poor. Ratkin you knew that because it's novice stuff....and....you also know that the bull is well past its average life expectancy so at this moment in time the bull certainly wouldn't be worrying about being killed off in the prime of its life...

But, just in case ...the chart below shows the lag between the Equity cycle and the economic cycle... the "wall of worry" is where the 8 4 5 and 7 are.. this is the period when some investors still worry whether the economic cycle has bottomed out or not...

Don't fret too much about the Market sectors being out of whack on the chart...the extra heavy handed QE has stuffed up theory..

Last edited by Hoop; 10-09-2015 at 01:38 PM.

-

10-09-2015, 01:48 PM

#632

Originally Posted by bull....

nice bounce of the support, I have a symmetrical triangle in play and we sit right at the top at the time of writing - if it breaks to upside the bull may be still alive an kicking.

poor people who panicked or who are in cash may have missed the buy of the year - time will tell even asx looked like a bottom yesterday?

Bull....

Tomi Kigore opinion on todays Marketwatch ....Dow’s bearish ‘symmetrical triangle’ remains in force

-

10-09-2015, 02:24 PM

#633

Originally Posted by Hoop

that's what im watching it is apparent on the S&P as well

- his target price seems wrong though as looks like he did the measurement wrong, point to point of the triangle gives me roughly 900pts target is the flash low on 24/8/15 ironic isn't it also a possible channel developing as well 16650 - 16050 which if breaks down targets almost the flash lows as well, also ironically fib 23.6 of the top is 15400 - 15500 around all those targets as well.

best policy is to see which way it breaks and then act up or down don't you think?

one step ahead of the herd

-

10-09-2015, 03:24 PM

#634

Clearly defined areas of doubt and uncertainity Clearly defined areas of doubt and uncertainity

-

11-09-2015, 08:24 AM

#635

With last nights TV news announcement of a potential recession and Elnino this summer.. whats your thoughts on the potential impacts on the market.

Do you think the decreased/decreasing interest rates will be positive or negative aspect for stocks.

-

11-09-2015, 10:30 AM

#636

Brazil: A bric(k) in the Global wall is crumbling Brazil: A bric(k) in the Global wall is crumbling

Originally Posted by Paper Tiger

Do you mean: "This time IT IS different" ?

At any given point in time you can probably define the probabilities of the current market being in every likely 'market 'state' and the probabilities of all the possible near future 'market states' (except for the ones with the black swans in them, damn those birds  ).

And when sufficient time has lapsed you can, with the benefit of hindsight, correctly define past 'market states'.

But the name of game is long term survival and maybe even profiting from the sequence of events as they unfurl around you.

May you strategy be successful.

Best Wishes

Paper Tiger

Disc: definitely deep and meaningful

Hi PT ..welcome back

Yeah ...so many ways this global world could turn at the moment..We are blessed with a mass of free valuable data(and tabloid junk) these days with an exception of NZ data (..I'm pissed off about this and if I bitch long enough ..the penny might drop that allowing up to date NZ data to be freely transmitted, it may encourage many more people to invest in the market place rather than it being sucked up into uneconomic investment areas such as property...

...but I'm digressing..back to the point.....and with all that data we can become educated and begin to assess the probabilities of each "happening" ourselves and freely debate it on forums such as ST.....

QE stuffing up theory...this time is different? ..nah Theory and Practice sometimes disagree and often do when a giant individual or a market sector supply/demand gets disrupted creating an imbalance somewhere within the entire networked system of things...The system is self correcting (sometimes to our disliking)..It can be fiddled with to be moderated but cycle theory says the big wheel can be sped up. slowed down or stopped but it can never reverse...therefore PT This time is never different...just different players...

Speaking about disruption..watch Brazil..it's economy has nosedived S&P has downgraded it financial instruments back to junk status last revisited in 2008 GFC..

Couta's Sheeples have been pleading for USA to do something about their rising US$ which they see as having a bad economic effect on emerging countries as most hold US$ nominated debt and setting off waves of devaluing currencies..Of Course everyone says US$ is only one factor....There's hope that Commodity prices have bottomed out (for now) and with the countering emerging country's currency devaluation used as a buffer to the low commodity prices + internal domestic economy restructure there is hope of an economic turnabout back to increasing GDP growth.. however Brazil could become a causality..and risk a ripple effect as it is the 8th largest world economy The BRIC countries are the largest emerging countries...

(Aust..NZ.. Canada are not classed as an emerging country but are reliant on commodity markets)

-

12-09-2015, 04:14 AM

#637

Originally Posted by Hoop

Hi PT ..welcome back

Yeah ...so many ways this global world could turn at the moment..We are blessed with a mass of free valuable data(and tabloid junk) these days with an exception of NZ data (..I'm pissed off about this and if I bitch long enough ..the penny might drop that allowing up to date NZ data to be freely transmitted, it may encourage many more people to invest in the market place rather than it being sucked up into uneconomic investment areas such as property...

Do you not use ami Quote? Can download all the free data you need. Can download it in metastock or amibroker format, the NZ data isnt live, buf for EOD data its quite adequate and is free

-

12-09-2015, 10:46 PM

#638

Meanwhile, my indicator share has dropped 52% from where it was 1 year ago, it's lower than it has been for nearly six years, but it still looks quite healthy compared to its level in 2008 during the GFC. Back then, it dropped to 15% of its high, and it started dropping just after early August 2007, the start of the GFC.

Last edited by elZorro; 12-09-2015 at 11:19 PM.

-

12-09-2015, 11:33 PM

#639

Originally Posted by elZorro

Meanwhile, my indicator share has dropped 52% from where it was 1 year ago, it's lower than it has been for nearly six years, but it still looks quite healthy compared to its level in 2008 during the GFC. Back then, it dropped to 15% of its high, and it started dropping just after early August 2007, the start of the GFC.

So what are you saying.. ???

You are happy with the way things are going ???

-

13-09-2015, 11:26 AM

#640

Originally Posted by janner

So what are you saying.. ???

You are happy with the way things are going ???

Let's say I'm in two minds, Janner. This share still crashed earlier in 2007-2008, despite the fact that they never lost money. They just sacked people and reduced stock until things came right.

After the GFC I told myself to keep looking at this share, because it rebounded about 8 fold or more (not that I had cash left to invest). Now it's on the way back down. If this share continues to drop at the rate it is, I won't be listening to any feel-good stories out there. And when this share finally holds a level and starts to rise again, I'll be expecting plenty of other things to come right as well.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

).

).

Bookmarks