-

22-02-2009, 01:53 PM

#201

Originally Posted by belgarion

Not aware of any macro news that could come out to protect that SP500 mark. We're going through it this week ... The question becomes - how far? - Gut says - not much. If it's large then opportunities will surface.

...interesting that since the top in 2007, markets have been falling steadily despite all the efforts of governments and Central banks to turn the deflationary tide. That points to the fact that governments and CB's have NO POWER at all to do anything about it despite the constant BLA-BLA Artist Brainwash of the system press to the contrary

...and the latest fall in the markets lead by the fall of banking shares points again to the fact that market wants the nationalization of insolvent to the core banks despite the CROOKS' view that the banks should stay private and should be helped out endlessly by the tax payer

...SO FAR THE MARKET WINS AND MOST LIKELY WILL CONTINUE TO WIN

Favoring nationalization:

Alan Greenspan

Gordon Brown, UK PM

Senate Banking Committee Chairman Christopher Dodd

Senator Chuck Schumer

Sen. Lindsey Graham

House Speaker Nancy Pelosi

Republicans (some)

Joseph Stiglitz

Paul Krugman

Alan S. Blinder, Princeton

Nassim Taleb

Nouriel Roubini

Greg Mankiw

J. Bradford DeLong

Elizabeth Warren, TARP Oversight Panel

Dennis Gartman

Chris Whalen

Josh Rosner

Jeff Matthews

John Mauldin

Jack McHugh

Bill King

Matthew Richardson

Dylan Ratigan (CNBC, Daily Beast)

Jesse Eisinger, Conde Nast Portfolio

Martin Wolf, FT

Aaron Task (Yahoo Tech Ticker)

Paul Kedrosky (Infectious Greed, CNBC)

Nicholas Kristof (New York Times)

Mark Gongloff (WSJ)

Richard Parker (Newsweek)

Michael Hirsh (Newsweek)

David Reilly (Bloomberg)

Paul Vigna (Dow Jones)

Henry Blodget (Silicon Alley)

Willem Buiter (FT)

Adam Posen (Peterson Institute for International Economics)

Jeff Macke

Todd Harrison

Calculated Risk (Preprivatize the Banks)

Mark Thoma (Economistsview)

Karl Denninger

naked capitalism

Eddy Elfenbein (Crossing Wall Street)

Bronte Capital

Aaron Krowne Mortgage Lender Implode-O-Meter

Prieur du Plessis (investmentpostcards)

Roger Ehrenberg, Information Arbitrage

Felix Salmon

Interfluidity (Nationalize Like Real Capitalists)

Urban Digs

opposed to nationalization:

Ben Bernanke

President Obama

Tim Geithner

Lawrence H. Summers

Financial Services Committee Chairman Barney Frank

Republican Senator Jon Kyl

George Soros

Meredith Whitney, Oppenheimer

Deroy Murdock (NRO)

Larry Kudlow

James Cramer

Hale Stewart

Tyler Cowen

http://www.ritholtz.com/blog/

...if the bank insolvency problem and the CDS issues remain unresolved, the market will continue to provide the RIGHT ANSWERS...(see attachment)

http://www.atlanticadvisors.com/uplo...ree-fallin.pdf

Kind Regards

Last edited by ananda77; 22-02-2009 at 10:37 PM.

-

22-02-2009, 11:49 PM

#202

Member

http://www.youtube.com/watch?v=TEzmU7YSXJs

Soundtrack for a meltdown

will be playing in my iPod through 2010, possibly 2011-2012......it will really complement the mass civil disturbances sure to cascade from nation to nation in the next few years.

----------------------

dead canaries are littering the ground everwhere

-

23-02-2009, 01:56 PM

#203

Tin-foil Hatter

For those who follow the Dow Theory, Friday's close was of particular significance. The Dow has finally given a confirmation signal; both the Dow Industrial and Dow Transportation have simultaneously broken lows, which means that the major second down leg is coming.

Up until Friday, Dow Theorists were still hanging on bullish hopes - not from today on.

God - Please give us just one more bubble....

-

23-02-2009, 11:31 PM

#204

A must to watch :

Inside the Meltdown.... 56 minutes...

http://www.pbs.org/wgbh/pages/frontline/meltdown/view/

cheers

WORK IS WHAT YOU MAKE IT !

"Never believe something is worthwhile if it compels you to break your promise"

-

24-02-2009, 07:42 AM

#205

Originally Posted by patsy

For those who follow the Dow Theory, Friday's close was of particular significance. The Dow has finally given a confirmation signal; both the Dow Industrial and Dow Transportation have simultaneously broken lows, which means that the major second down leg is coming.

Up until Friday, Dow Theorists were still hanging on bullish hopes - not from today on.

...but was not confirmed by the Nasdaq nor the SPX 500 and trading distorted by option expiration; very critical junction this week;

-this morning:

-Dow testing support *7198 possible extension south to *7000

-SPX 500 testing *750 possible extension south to *741/*725

...if this support does not hold, market goes lower

Trading Strategy: met target on SPX 500 and on the sideline

Kind Regards

-

24-02-2009, 07:52 AM

#206

Dow down again this morning.

This is getting very ugly. I cant see any light at the end of this tunnel.

Doc is very bearish.

Having got ourselves into a debt-induced economic crisis, the only permanent way out is to reduce the debt – either directly by abolishing large slabs of it, or indirectly by inflating it away.

-

24-02-2009, 08:37 AM

#207

12 year lows, clear tone of capitulation. I'm on the cusp of being extremely bullish.

75%-80% cash, no debts of any sort and ready to go. Very scary environment though, confidence shot to bits and very hard to go against the herd.

However, as the currently deeply unpopular Mr Buffett says, you pay a very high price for a cheery consensus. We had an incredibly cheery consensus in 2006/2007 and, boy, has the price turned out high.

What about now, though?

----

Never try to teach a pig to sing. It wastes your time and annoys the pig.

----

-

24-02-2009, 09:05 AM

#208

Disclaimer: Do not take my posts seriously. They are only opinions.

AMR has sold all shares and is pursuing property.

-

24-02-2009, 07:11 PM

#209

Originally Posted by Stranger_Danger

12 year lows, clear tone of capitulation. I'm on the cusp of being extremely bullish.

75%-80% cash, no debts of any sort and ready to go. Very scary environment though, confidence shot to bits and very hard to go against the herd.

However, as the currently deeply unpopular Mr Buffett says, you pay a very high price for a cheery consensus. We had an incredibly cheery consensus in 2006/2007 and, boy, has the price turned out high.

What about now, though?

Yup the final capitulation is what i'm waiting for too, as most people won't recognise the start of the new bull market, & whilst scared & out of the market will miss much of the early gains...

When everyone is bearish time to start buying "selective stocks"

-

25-02-2009, 06:39 AM

#210

Originally Posted by AMR

Rob from Quantifiable edges also feels that way...

CBI Hits 7 For 1st Time Since November

I haven’t mentioned the Capitualtive Breadth Indicator (CBI) for a while. For those unfamiliar it is a proprietary method of measuring the amount of capitulation evident in the market. You may read the intro post here or the entire series here. Since the November lows it has been pretty much dormant except for a quick blip in January. It began to move up last week and at Friday’s close it hit 7. Long-time readers will recall that this is a level where I feel a decent bullish edge exists. Below is a chart of the CBI from the Quantifiable Edges members section.

(click to enlarge)

In the past I’ve demonstrated that it can be used as a market timing tool for swing trades. One “system” I’ve shown here on the blog is to purchase the S&P 500 when the CBI hits a certain level (7 being one of them) and then sell the S&P when it returns back to 3 or below.

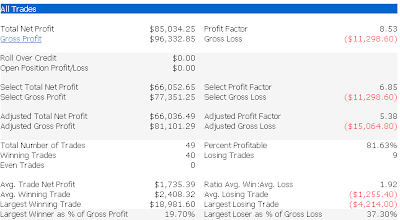

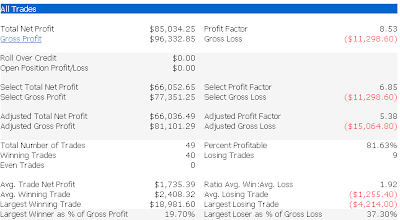

Below is an updated performance report of the above “system” covering 1995-present.

I'll keep readers informed of significant changes in the CBI over the next several days until it returns to neutral.

This joker has a different view .... says 'In 1931, after the Dow broke below the 1930 lows, it was virtually non-stop to the bottom apart from minor upward jerks every six months.' ... and that is where we are now

http://www.businessspectator.com.au/bs.nsf/Article/Market-$pd20090224-PJV6S?OpenDocument&src=sph

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks