-

26-05-2011, 11:43 AM

#651

Well Belg...so far so good nearly half a year gone and the DOW is headed for its third up year in a row....

Statistics say 3 up years in a row is rare in a Secular Bear Cycle

and....

Simple basic market theory and Hypothesis sees the DOW bull market could be maturing in its possible BM phase3.

as I said a long time ago on this Thread any distance above 11500 would make me worry.

Can the DOW keep above 31 December 2010 figure at 31 December 2011?

-

04-08-2011, 09:55 AM

#652

Bull Market Cycle RIP 2/8/2011 Bull Market Cycle RIP 2/8/2011

That rare 3 years of rises in a secular bear market is looking distant now

The DOW Theory just signalled a primary tide Bear Market confirmed on the 2nd August 2011.

This event happens when both primary up trendlines break...... the DOW Ind index gets a confirmation with the DOW Transport Index or vice versa.

Edit: forgot to add the extra requirement ::: as well as the primary trendbreak, the index has to drop below their previous low point (Not drawn on the chart)

The DOW theory although looks simple on a chart is a highly reliable signal indicator.

Last edited by Hoop; 04-08-2011 at 12:37 PM.

Reason: see Edit in the post

-

04-08-2011, 11:48 AM

#653

Originally Posted by belgarion

Hoop, I'd love to agree with you but feel the trend line breaks are driven by macro events that have limited long term effects. E.g. Japan earthquake, US debt bollocks, European debt, etc. Meanwhile the BRICs, the engines for global growth, just keep on keeping on albeit some of the BRIC's govts are reigning in growth (and inflation). Time will tell but I'm not convinced the cyclical bull is over just yet. (That said I'm pretty cashed up and not seriously buying anything unless a) has a history of growing earnings and b) has a high current yeild and c) is protected from FX movements.

Time will tell

The market index charts is a only a historic visual display of group equity investor behaviour. Secular market human group behaviour follows patterns..

How can the sharemarket fall when the economy finally comes right????? one might ask

It is interesting atm in the USA because the American companies are making record profits!!!! yet the sharemarket doesn't fully recognise this... it has rallied into a cyclic bull market since 2009 but not to record highs...why? because of the group investor demands for higher yields to offset higher perceived risk...This is typical behaviour in a secular bear market environment

What is happening next???...record company profits are unsustainable and expected to see a tapering off their record highs in 2012 ..this effect will see a general downward pressure on Equity prices..........The economy is expected to suddenly come right and this will create less perceived risk resulting in upward pressure, but it is not enough as an improved economy causes inflationary events triggering a tightening of money supply higher interest rates, currency gains and all these have a larger combined large downward effect on the Equity Market and that market has to again increase yields to now compete with the money/currency and other markets.

The economy has no long term effect on the sharemarket...It may sound like a paradox but the economy runs just as good during a secular bear cycle as it does during the secular bull cycle...the difference is the group investors behaviour as they demand better returns and take less speculated risks during secular bear periods than in secular bull periods...hence causing a long term downtrend in the P/E Ratio over the time of the secular bear market cycle.

Therefore PE Ratio is the key driver and inflation is its secondary driver effecting cyclic and secular cycles of the Sharemarket. Economic events have only "ripple" effects within cyclic cycles.

Last edited by Hoop; 04-08-2011 at 11:55 AM.

Reason: slight change of wording

-

07-08-2011, 12:23 AM

#654

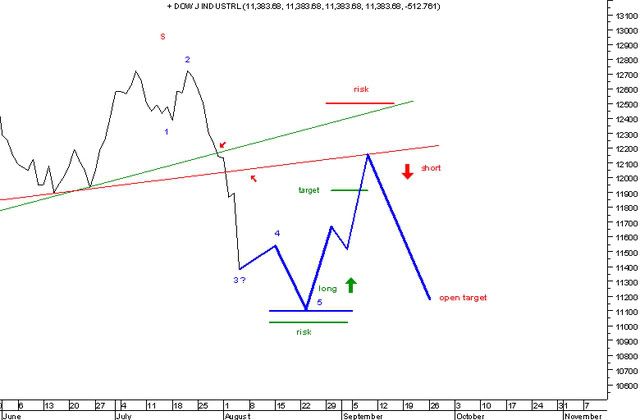

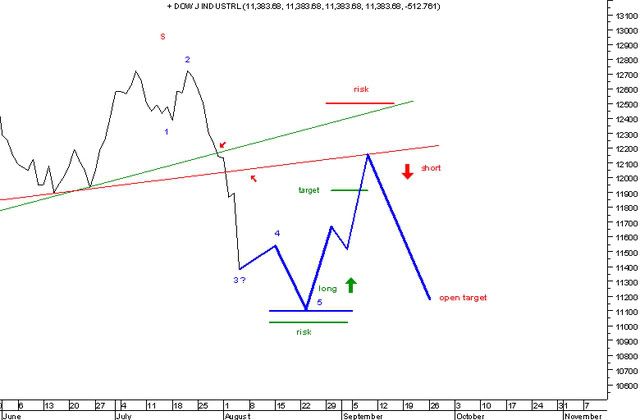

looks very much like the end of the bull market and this becomes my preferred count.

5 completed waves up from 09 low, so now looking for a 3 wave bear market going south.

clear break of 3 year trendline.

head and shoulders topping pattern printed with neckline break.

total bugger really !

-

07-08-2011, 11:26 AM

#655

Originally Posted by dumbass

looks very much like the end of the bull market and this becomes my preferred count.

5 completed waves up from 09 low, so now looking for a 3 wave bear market going south.

clear break of 3 year trendline.

head and shoulders topping pattern printed with neckline break.

total bugger really !

Thanks for the EW Dumbass

Even more of a total bugger when the differing TA disciplines all agree to the same conclusion...eh?

The US Equity markets may seem fundamentally OK but this latest weakness has created huge technical damage.

Last edited by Hoop; 07-08-2011 at 11:32 AM.

-

07-08-2011, 12:10 PM

#656

do you have any thoughts on targets and time frames Hoop.

im thiking its most likely going to run between 1 to 3 years with a target around 9700 or worse case low 8000's.

in corrections wave patterns can run from simple zig zag patterns to complex affairs but will always be 3 main waves.

need to keep your wits about you when it comes to trading with long grinding down waves with counter trending sharp rallies.

-

07-08-2011, 03:13 PM

#657

Damm...internet dropped out and lost my reply spent 20 minutes on it I wont retype

Dumbass..short version if it is a bear market cycle we will see all the 3 stage patterns over an unknown life span ( average 15 to 18 months).. the severeity is unknown could be a cuddly teddy bear or a man eating grizzly.

The next couple of weeks we may see 11000 there is a support to break first however...watch for pullback to test the neck-neck trendline happens 64% of the timebefore the next posssible fall off (Ref Thomas Bulkowski)

Last edited by Hoop; 07-08-2011 at 03:14 PM.

-

07-08-2011, 07:12 PM

#658

this is my trading plan for the next week or two , of course it wont pan out so neatly but looking for

1 fourth and fifth waves of this decline , market may have already put in a base aroun 11,100 will be loooking for a double bottom and indicator divergence to go long with risk and target defined

2 looking for test on either h+s neck line or green trendline

neck line should be aroung 61.8 retracement of wave down then looking to go short with risk defined amd open target at the moment

3 all bets are off if the 11 100 does not hold then the market is in serious trouble and will short the living daylights out the market

4 my feeling the credit downgrade will not be market moving in the short term.

-

08-08-2011, 08:46 AM

#659

currency markets open and not much of a reaction on nzd

looks like a move into swiss otherwise muted opening.

my personal feeling is not much of a market mover but no doubt volatilty will be high.

-

08-08-2011, 08:32 PM

#660

I'm a charting novice and for me simple is better. But, I don't like the look of this at all....

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks