-

20-05-2016, 09:20 AM

#2701

Congrats to holders especially Vaygor1 - Mate I look forward to shouting you a beer when I see you in due course. Agree that the SP has had a big run-up. Is a good hold for the long run...Disc - Presently not holding but looking to add some on any meaningful dip. (Not to be considered professional advice, DYOR)

-

20-05-2016, 03:31 PM

#2702

This company is an absolute No Brainer,especially for anyone wanting a long term investment that you don't really need to keep your eyes on.

And you can see the future growth happening with new sites. Aussie has such huge potential.

-

20-05-2016, 04:07 PM

#2703

Currently sitting on a 1,867% profit on RYM and still happy to hold

-

20-05-2016, 04:32 PM

#2704

Hmmm, either your a trader or you sold down

-

20-05-2016, 11:56 PM

#2705

Originally Posted by Lewylewylewy

Hmmm, either your a trader or you sold down

It comes from being a holder since 2003 with only a few sell/buys since

-

21-05-2016, 08:09 AM

#2706

Originally Posted by minimoke

Currently sitting on a 1,867% profit on RYM and still happy to hold

Fantastic..

Well done.

Trust the next 13 years are as good for you.!

-

21-05-2016, 09:05 AM

#2707

Originally Posted by percy

Fantastic..

Well done.

Trust the next 13 years are as good for you.!

by then i might be an occupant of one of their properties. Maybe theyll offer a discount to long term holders.

-

21-05-2016, 12:52 PM

#2708

Originally Posted by Roger

Congrats to holders especially Vaygor1 - Mate I look forward to shouting you a beer when I see you in due course. Agree that the SP has had a big run-up. Is a good hold for the long run...Disc - Presently not holding but looking to add some on any meaningful dip. (Not to be considered professional advice, DYOR)

Thanks Roger.

I will happily accept a beer from you on the condition you gracefully accept one from me too.

As per my earlier post a $158M Underlying Profit equates to a fair SP range of $9.15 to $9.40 by my calcs.

Assuming consistent growth, an SP approaching $11 this time next year is on the cards imho.

In the meantime any dip below $9.00 represents reasonable buying in my view, and during the course of the next 12 months this is reasonably likely to occur on at least one occasion. So long as RYM maintains its current consistent growth rate, I find it difficult to imagine the Share Price dropping below the $8.30 mark in the foreseeable future.

-

21-05-2016, 01:12 PM

#2709

Originally Posted by Vaygor1

Thanks Roger.

I will happily accept a beer from you on the condition you gracefully accept one from me too.

As per my earlier post a $158M Underlying Profit equates to a fair SP range of $9.15 to $9.40 by my calcs.

Assuming consistent growth, an SP approaching $11 this time next year is on the cards imho.

In the meantime any dip below $9.00 represents reasonable buying in my view, and during the course of the next 12 months this is reasonably likely to occur on at least one occasion. So long as RYM maintains its current consistent growth rate, I find it difficult to imagine the Share Price dropping below the $8.30 mark in the foreseeable future.

Thanks mate, looking forward too it. Always appreciate your insights

-

03-06-2016, 09:57 PM

#2710

Is this going to affect Ryman in Aus too?.Int link at the bottom too but my eyes glazed over.

In light of yesterday's sharemarket rout of listed residential aged care players, triggered by the release of a BAML research report forecasting a potential 13% decrease in ACFI funding rates, I want to discuss briefly (1) ACFI claiming practices in the industry; and (2) balance sheet implications.

Aggressive ACFI claiming Practices

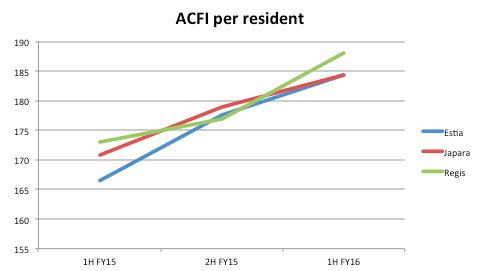

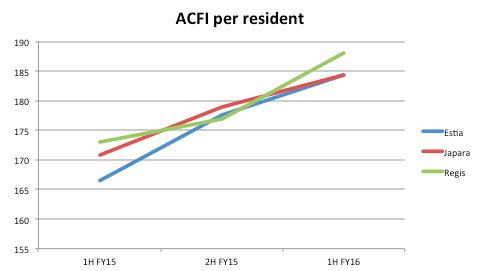

The listed sector have thrived of late on constant increases in ACFI claims achieved per resident - at a rate of 10.7%, 8.0% and 8.7% per annum for Estia, Japara and Regis respectively.

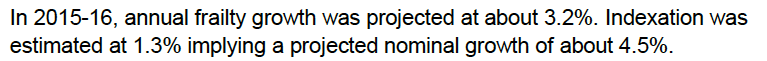

This is twice the growth rate that the government is comfortable with (as per below from its ACFI Monitoring Report):

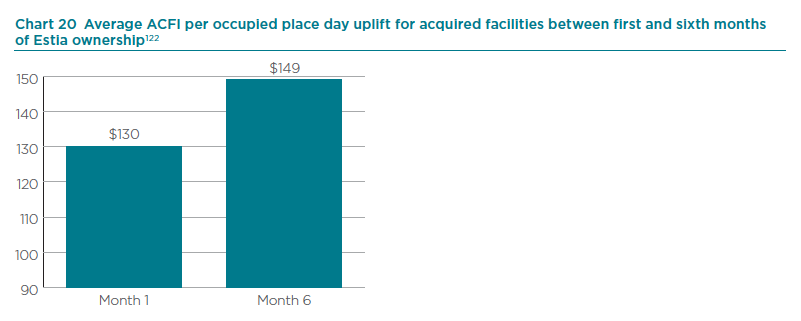

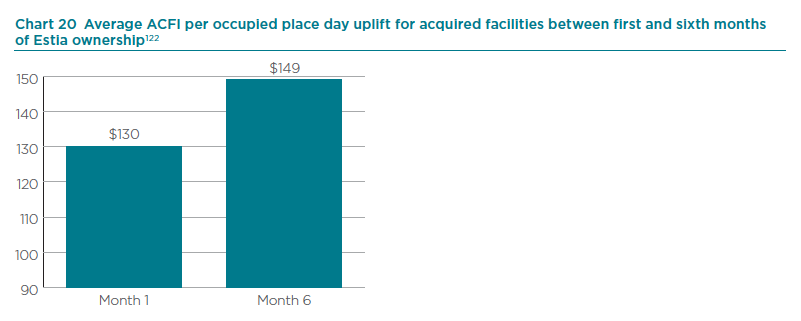

In fact, Estia brags about its ability to claw higher ACFI payment per resident out of the government under its ownership, charging the Australian Government 15% more per resident within 6 months after acquiring a new facility.

How? Apparently through "improved documentation and compliance standards":

Probably not the most prudent assertion for Estia to have made in the public domain in an environment where the government states explicitly in its most recent Mid Year Economic and Fiscal Outlook that: Probably not the most prudent assertion for Estia to have made in the public domain in an environment where the government states explicitly in its most recent Mid Year Economic and Fiscal Outlook that:

Expenditure on residential aged care subsidies under the ACFI for 2014-15 has exceeded budget estimates by approximately $150 million. This level of growth is not sustainable for Government. It is clear that the growth is being driven by claims in the complex health care domain which are higher than can be explained by the increase in the frailty of residents.

While the overwhelming majority of ACFI claims from aged care providers audited by the Department of Health are correct, one-in-eight of 20,000 checked last year (2014-15) were deemed to be incorrect or false. This figure is already tracking even higher at one-in-seven in 2015-16. Balance Sheet Fragility

Given that more than 70% of industry revenue is derived from the government, industry economics is obviously hugely sensitive to changes in government policy. The apparent sector-wide "EPS reductions of -19% to -27% by FY2019E" (taken from BALM research report at face value) from a seemingly small revision in the May Federal budget is demonstrative of this.

As we've established in my previous article, balance sheet assets of Estia, Regis and Japara comprise a huge amount goodwill from acquisitions, without which Net Assets are actually negative or close to negative.

Note: Regis numbers Incorporates Masonic Care Acquisition Note: Regis numbers Incorporates Masonic Care Acquisition

It is then not too difficult to see a scenario where, given any deterioration in industry conditions, a material amount of balance sheet goodwill is deemed impaired especially in context of huge acquisition multiples having been paid for those assets in question.

Note that a significant portion of those goodwill assets have been paid for using liabilities in the form of Refundable Accommodation Deposits (lent to the providers by its residents).

This could very well wreck havoc on already thinly capitalised Balance Sheets.

Here's my original detailed article on Leverage in the Australian Residential Aged Care Sector.

|

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Probably not the most prudent assertion for Estia to have made in the public domain in an environment where the government states explicitly in its most recent

Probably not the most prudent assertion for Estia to have made in the public domain in an environment where the government states explicitly in its most recent

Bookmarks