-

25-09-2017, 03:35 PM

#14271

Originally Posted by Adam H

I do agree that tourist are a consideration, and to me are the only saving grace of GST.

I think your proposal has some merit, but i would still favour removing GST. I also would not support a flat tax above $25K even with your system. The extra bit of GST is not going to make up for all the lost income tax. Also based on your proposal people who earn around the average income (~$50K) would take a decent hit if implemented. I don't think that's a good thing.

Currently tax on $50k is $8000 plus. 20% 0n income above 25k is $5000. If they spent every last cent on GST included items (hardly likely) they would be paying an extra $2500, totaling $7500. Still lower than $8000. Doesn't seem like a hit to me. You assume a loss of tax take overall. Don't be so sure about that. There would be a huge lift in the economy - and a huge swing from the black economy to the visible one; not to mention various legal tax avoidance schemes that would lose their appeal.

Last edited by fungus pudding; 25-09-2017 at 03:36 PM.

-

25-09-2017, 03:47 PM

#14272

Originally Posted by Adam H

Silly me i forgot about rent. However my point is still valid, they pay a MUCH higher % of their wealth into GST.

Noting that rental on a residential dwelling is a GST exempt supply (i.e. no GST on residential rent).

Whilst you say that GST is a regressive tax (proportionally, it taxes those who are on lower incomes as they proportionally spend more) - we also have a progressive income tax regimes that has lower rates of income tax for lower earners and arguably with those on Working For Families, even lower rates again to the extent some families with the Family Tax Credit may have very small net income tax obligations.

On the other hand, GST has merits as a tax as it is relatively cheap to collect (the taxpayer is obligated to pay and file returns) and relatively hard to evade paying as most businesses will charge the GST and remit it in accordance with the law, wealthier people tend to spend more so pay larger amounts of GST per capita, it also collects tax from tourists and other folk who don't declare assessable income but may have wealth. And apart from the aforementioned exempt supply of rental on a residential dwelling, financial services, going concerns and exported goods and services it's taxed at the same rate and has relatively few exemptions. Snapping on exemptions for food, local government rates or exempting some persons offers the opportunity for avoidance and the compliance costs are borne by taxpayers to have systems to keep track.... eg if there was an exemption for GST on basic food - if you are a baker how are you going to apportion the flour on a basic loaf as opposed to banana bread - or on the electricity on the oven baking the bread.... or keep track of the GST exempt and inclusive supplies at the farmers market?

On a tangent, the water tax doesn't pass the sniff test - I see merit in creating some sort of mechanism for polluter pays to clean up our rivers but why should say a Taranaki or Waikato Dairy Farmer who has significant nitrate runoff, does no fencing of waterways and no riparian planting but adequate rainfall not pay water tax whereas a horticulturalist with hydroponics using a semi-closed system and reusing runoff (potentially using aquaponics) be charged to clean up waterways?

Last edited by Rep; 25-09-2017 at 03:48 PM.

Reason: spelling of capital as opposed to per capita

-

25-09-2017, 04:02 PM

#14273

Junior Member

Originally Posted by fungus pudding

Currently tax on $50k is $8000 plus. 20% 0n income above 25k is $5000. If they spent every last cent on GST included items (hardly likely) they would be paying an extra $2500, totaling $7500. Still lower than $8000. Doesn't seem like a hit to me. You assume a loss of tax take overall. Don't be so sure about that. There would be a huge lift in the economy - and a huge swing from the black economy to the visible one; not to mention various legal tax avoidance schemes that would lose their appeal.

I obviously should have gotten that calculator out.

I don't see how the take is not going to be less. Less tax for the lowest earners, less for average earners and obviously less for the highest earners who will benefit the most in dollar terms. Not sure where the extra tax comes from, the extra 5% from tourists wont add up. I realise you just gave an example to support your idea for a tax system and the numbers could be tweaked, but it cannot be a benefit for everyone if the total take is going to be the same.

Last edited by Adam H; 25-09-2017 at 04:24 PM.

-

25-09-2017, 04:08 PM

#14274

Originally Posted by Adam H

I obviously should have gotten that calculator out.

I don't see how the take is going to be less. Less tax for the lowest earners, less for average earners and obviously less for the highest earners will will benefit the most in dollar terms? Not sure where the extra tax comes from, the extra 5% from tourists wont add up. I realise you just gave an example to support your idea for a tax system and the numbers could be tweaked, but it cannot be a benefit for everyone if the total take is going to be the same.

It could. I think one thing FP is referring to is less tax avoidance. Much harder to avoid GST ... and some of the other constructs just don't provide sufficient return to bother creating them with a flat income tax rate ...

As well - people who currently live for tax reasons in foreign countries might return to a tax friendlier NZ - and start to contribute to our taxe take.

But I guess you are right - people avoiding tax now might pay a bit more - and I could live with that  . .

----

"Prediction is very difficult, especially about the future" (Niels Bohr)

-

25-09-2017, 04:16 PM

#14275

Junior Member

Originally Posted by Rep

Noting that rental on a residential dwelling is a GST exempt supply (i.e. no GST on residential rent).

Whilst you say that GST is a regressive tax (proportionally, it taxes those who are on lower incomes as they proportionally spend more) - we also have a progressive income tax regimes that has lower rates of income tax for lower earners and arguably with those on Working For Families, even lower rates again to the extent some families with the Family Tax Credit may have very small net income tax obligations.

On the other hand, GST has merits as a tax as it is relatively cheap to collect (the taxpayer is obligated to pay and file returns) and relatively hard to evade paying as most businesses will charge the GST and remit it in accordance with the law, wealthier people tend to spend more so pay larger amounts of GST per capita, it also collects tax from tourists and other folk who don't declare assessable income but may have wealth. And apart from the aforementioned exempt supply of rental on a residential dwelling, financial services, going concerns and exported goods and services it's taxed at the same rate and has relatively few exemptions. Snapping on exemptions for food, local government rates or exempting some persons offers the opportunity for avoidance and the compliance costs are borne by taxpayers to have systems to keep track.... eg if there was an exemption for GST on basic food - if you are a baker how are you going to apportion the flour on a basic loaf as opposed to banana bread - or on the electricity on the oven baking the bread.... or keep track of the GST exempt and inclusive supplies at the farmers market?

On a tangent, the water tax doesn't pass the sniff test - I see merit in creating some sort of mechanism for polluter pays to clean up our rivers but why should say a Taranaki or Waikato Dairy Farmer who has significant nitrate runoff, does no fencing of waterways and no riparian planting but adequate rainfall not pay water tax whereas a horticulturalist with hydroponics using a semi-closed system and reusing runoff (potentially using aquaponics) be charged to clean up waterways?

I don't think we disagree on any of the points you or i have mentioned.

I think most would agree that having a simple tax system is good. The system here in NZ is much simpler than many overseas countries who implement the exemption system you mentioned. If we are going to have GST i think the flat rate is much better, i believe this is what you support as well?

I voted Green and even i am not that supportive of the water tax. It is promoted as polluter pays but targets water users in general, not polluters as you have said. Crop farmers in Canterbury use a fair bit of water but certainly wont be contributing to the detriment of the waterways the same as diary. I would rather a focus on improving the water quality through enforcement of policy and regulations, i don't think this needs to be paid for exclusively by NZ farmers who irrigate and would rather they just got it done rather than looking for a specific section of the community to pay the bill.

-

25-09-2017, 05:12 PM

#14276

Originally Posted by Adam H

I obviously should have gotten that calculator out.

I don't see how the take is not going to be less. Less tax for the lowest earners, less for average earners and obviously less for the highest earners who will benefit the most in dollar terms. Not sure where the extra tax comes from, the extra 5% from tourists wont add up. I realise you just gave an example to support your idea for a tax system and the numbers could be tweaked, but it cannot be a benefit for everyone if the total take is going to be the same.

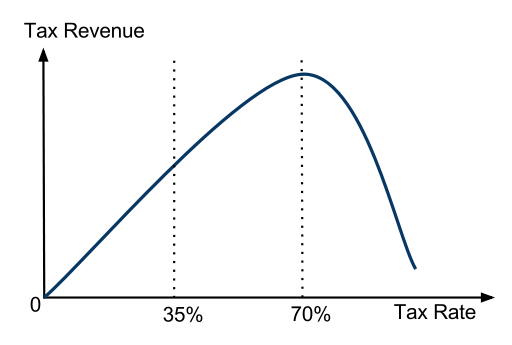

The total tax take may well go up. If you are familiar with Laffer the economist, have a look at the Laffer curve. Its basic premise is that at 0% tax the govt gets nothing - which is exacltly what they would get if the tax rate was 100%. (Nobody would do anything or if they did they wouldn't charge for it. The whole economy would be under the table, or untraced bata) In simple terms raising taxes may lower the tax take - and as happened in NZ after Muldoon's 66% - lowering taxes increased the tax take. So it all depends where we sit on the Laffer curve.

-

25-09-2017, 05:32 PM

#14277

Originally Posted by fungus pudding

The total tax take may well go up. If you are familiar with Laffer the economist, have a look at the Laffer curve. Its basic premise is that at 0% tax the govt gets nothing - which is exacltly what they would get if the tax rate was 100%. (Nobody would do anything or if they did they wouldn't charge for it. The whole economy would be under the table, or untraced bata) In simple terms raising taxes may lower the tax take - and as happened in NZ after Muldoon's 66% - lowering taxes increased the tax take. So it all depends where we sit on the Laffer curve.

I remember in the old days whilst working in the shearing gangs and the Shearer's tax was 50%. Quite a few back then used to use a different name and IRD number at every farm they went to as you had to fill out a new tax form for each farm. If the tax rate had have been more reasonable , they wouldn't have bothered using those measures at the time.

-

25-09-2017, 05:43 PM

#14278

Originally Posted by couta1

I remember in the old days whilst working in the shearing gangs and the Shearer's tax was 50%. Quite a few back then used to use a different name and IRD number at every farm they went to as you had to fill out a new tax form for each farm. If the tax rate had have been more reasonable , they wouldn't have bothered using those measures at the time.

http://www.investopedia.com/terms/l/laffercurve.asp

-

25-09-2017, 07:14 PM

#14279

Junior Member

-

25-09-2017, 07:17 PM

#14280

“ At the top of every bubble, everyone is convinced it's not yet a bubble.”

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

.

.

Bookmarks