-

Member

Results for Q1 are available Results for Q1 are available

Yesterday CGA released it's first Quarter results for 2014. The market valued CGA's shareprice 7% lower!

Why ?

IMO, it was the anouncement of 25 Millions in deferred Assets. Today the 10Q wasw sin and we caqn read the Explanation:

Deferred assetDeferred asset represents amounts that the Company advanced to the distributors in their marketing efforts and developing standard stores to expand the Company’s products’ competitiveness and market shares. The amount owed to the Company to assist its distributors will be expensed over three years as long as the distributors are actively selling the Company’s products.If a distributor breaches, defaults, or terminates the agreement with the Company within the three year period, the outstanding unamortized portion of the amount owed is payable to the Company immediately. The Company’s Chairman, Mr. Li, guaranteed to the Company of amounts remaining unpaid due from distributors.

Revenue and Earnings were great if you put in mind the decreased Prices in the fertilizer markets:

income-cga.jpg

-

Member

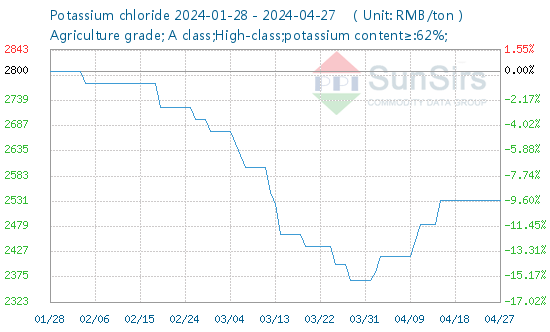

UREA prices up UREA prices up

UREA prices up. Hopefuly this trend continues. It could be a good chance to beat expectations.

http://www.sunsirs.com/uk/prodetail-89.html

Can someone tell me how to paste the picture into this board ? I always have the problem that it is so small.

-

Member

Yongye a chinese competitor Yongye a chinese competitor

Currently their is an offer for CGA's competitor "Yongye". This going private attempt is led by Morgan Stanley. The offer values the shares of the private investors with a P/E of 2. It seems that

this crime will be rejected. And i am hoping for a move to HSE, where chinese firms have a better valuation. If Yongye will do so, CGA will follow. If the going private is succesfull, CGA will follow,

thats my fear.

http://www.fool.com/investing/genera...rtchanged.aspx

We have a high oppurtunity that CGA will be a five-bagger within a few years. I know that Kiwi Investors have a lot of knowledge regarding Agriculture. Hopefully a few of you will join this adventure,

and help me to understand the company.

Last edited by Agrarinvestor; 10-12-2013 at 06:26 AM.

-

Member

CGA Breaking News CGA Breaking News

Today we got great News. Market has reacted a little bit, but i beleave we see 30% plus until year end. I beleave this

message is important:

http://finance.yahoo.com/news/quarte...130500272.html

CGA is added to the Nasdaq Golden Dragon Index. I am currently investigating what happens to the candidates that were added

6 month ago:

http://online.wsj.com/article/PR-CO-...1-904386.html#

-

Member

Competition and Prices Competition and Prices

|

Mosaic |

Agrium |

Potash Corp |

K+S |

YongYE |

CF Industies |

CGA |

| P/E (TTM) |

10,9 |

9,95 |

12,56 |

7,29 |

3,04 |

8,26 |

2,54 |

| Price to Bookvalue (MRQ) |

1,53 |

1,83 |

2,73 |

1,15 |

0,63 |

2,47 |

0,41 |

| Price to tabgible Bookvalue (MRQ) |

1,77 |

2,97 |

2,75 |

1,62 |

0,59 |

4,1 |

0,49 |

| EPS(MRQ) vs Qtr 1 Yr ago |

-4,55 |

-7,65 |

22,95 |

-37 |

|

-35,9 |

23,61 |

| EPS -5Yr. Growth Rate |

-1,05 |

-24,18 |

16,82 |

|

33,65 |

34,21 |

24,94 |

|

|

|

|

|

|

|

|

| Margen |

|

|

|

|

|

|

|

| Gross Margin (TTM) |

27,67 |

25,89 |

41,84 |

44,54 |

60,13 |

45,87 |

36,6 |

| Operating Margin (TTM) |

22,15 |

11,57 |

40,12 |

19,87 |

27,71 |

43,75 |

25,54 |

| Net Profit Margin (TTM) |

18,78 |

8,33 |

28,21 |

12,6 |

23,55 |

27,2 |

20,64 |

|

47$ |

89$ |

32$ |

19E |

6,3$ |

213$ |

4$ |

|

The Table above is from November 2013. But the major points has not changed much since than. Fact is price are under pressure.

Potash prices sharper than prices for Urea. That is very good for CGA. I beleave most competitors will have problems to earn money in Q4 2013,

and Q1 2014.

These are the prices for UREA and Potash:

-

Member

Coal and UREA Coal and UREA

As long as we have decreasing coal prices, we will see stable margins, because competition in US is producing Urea out of natural gas,

and chinese UREA producers using coal.

http://marketrealist.com/2013/07/why...s-down-part-3/

-

We can see very interesting discussions here. Thank you.

-

Member

I have made an error. CGA's main product is Humic Acid, not Urea

-

Member

. CGA's main product is Humic Acid, not Urea . CGA's main product is Humic Acid, not Urea

I have made an error. CGA's main product is Humic Acid, not Urea

-

Member

Kone another company of Tao Li has raised 300% Kone another company of Tao Li has raised 300%

The CEO of CGA has founded another Company called Kone. Kone raised this year for 300%. Still writing losses, but large inprovements in revenue and gross margin:

http://www.thestreet.com/story/12244621/1/why-kingt

one-wirelessinfo-solutions-kone-is-skyrocketing-today.html?puc=yahoo&cm_ven=YAHOO

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks