-

Yesterday, 09:53 AM

#19791

Member

Hi all. My latest column published on my Substack, Just the Business, takes a look at the NZX-listed retirement operators and how they rank, including that Summerset is likely to overtake Ryman as the largest in the sector in a few years. It includes comment on Oceania. The headline is: Mirror, Mirror on the wall, which is the biggest retirement village operator?

And you can find it here: https://substack.com/@justthebusinessjennyruth

-

Things seem to have gone downhill at Oceania since Brent told Mark Stockton not to come in on Monday a few years ago

One of a quite a few comings and goings in the Executive Team in last couple of years.

Last edited by winner69; Today at 09:06 AM.

“ At the top of every bubble, everyone is convinced it's not yet a bubble.”

-

Jeez …shareprice hit 57 cents

Hope it recovers by end of day

Value probably buying so that might stop the slide

“ At the top of every bubble, everyone is convinced it's not yet a bubble.”

-

Originally Posted by winner69

Jeez …shareprice hit 57 cents

Hope it recovers by end of day

Value probably buying so that might stop the slide

Maybe might buy a few thousand worth tomorrow... I don't know whats more appealing, STLA at $22.30 USD or OCA at 57c.

Both are cheap as hell.

-

NZ housing stats came out recently which I use as the main benchmark factor towards expectations for OCA sales.

There are other influencers such as what stage each delivery is at in its sell down which I'll add below.

As earlier posted , this last result really upset me as OCA has a ton of ready to go stock . Then coupled with SUM and ARV sales were good positive indicators, plus high sales volume for OCA in HY1 all pointed to a very good OCA result.

The actual result of c.37 new apartment sales (derived from their unspecific update) was in my mind a shocker and a significant disappointment.

Today's NZ stats tempers my disappointment to a degree as it offers a partial reason for the poor sales.

Q1 24 NZ sales were down significantly to such an extent that when added to Q4 23 ( that is the same period as OCA 2HY24) then we get almost identical NZ sales rates/ environment during OCA`s FY23.

In other words OCA sold 16% of its available stock HY2 24 while over the entire FY23 during an almost identical sales environment it sold 16% and 19% per OCA HY.

One could argue OCA 2HY24 sales were down only 2% on expectations based solely on NZ house sales data/ environment when compared to averaged OCA 1hy23 and OCA 2Hy23.

So while 2% down is disappointing , it's not as disastrous as first thought given the NZ sales backdrop.

The other specific OCA sales factor is that Helier is selling down from a cold start ( empty) so sales are always sluggish during this phase as there isn't the enthusiasm to move into a near empty building. To be fair , OCA tried to secure pre-sales with a specific sales office in the Helier township complete with computer walkthroughs and an impressive model of the completed Helier itself. Plus an opening featuring an ex All Black coach all to get pre sales rolling . Both these initiatives seemed to have had little effect. Preselling apartments seems nigh impossible...so when ARV say c.50% ( ish from memory) of their apartments at Aria bay sold just after opening, it wasn't true, they were grandfathered from a nearby village. When SUM say they have c.60% presold at St Johns about to start opening late this year...I dont believe them or at least they won`t translate into actual sales.

Now getting back to the normal pattern of apartment selling down , the initial ghost like community vibe obviously ramps up as the population grows. Helier , with c.15-20 residents now should be starting to gain that vibe.

ChCh is a similar situation but not quite as empty given there are full apartments around the corner from a previous delivery.

So after today's result I am not as dark on their ability to sell stock or concerned about its possible fallout out of desirability as I was a few weeks ago. Forbar said OCA will only get going when the property market starts moving again which seems a perfect summary.

Thanks Baa baa for highlighting they now have just employed a specific sales position at the top ( was a shared role) starting now. Clearly they are aware of this significant issue and trying to address it.

I'm not making excuses by any means for OCAs very poor sales but in context of this new data I'm no longer as bitterly disappointed as I was.

Last edited by Maverick; Today at 04:03 PM.

-

Hey Mav

If we looking at same data https://www.stats.govt.nz/informatio...-2024-quarter/. I’d say property market doing quite well. Last 2 qtrs (OCA H2) sales up 14% on pcp following +6% in the previous 2 quarters. NZIER reported volumes were up 5% and 22% on pcp.

Overall numbers 12 months March up 10%

OCA sales up 38% v pcp in H1 and only 3% in H2 ….the spike in H1 and the rumour that H223 sales May have been ‘managed’ has resulted in the sales trend looking lumpy eh….goodness knows what’s going on especially when ARV and SUM had strong 2nd half.

I can sort of see where you are coming from and it will be interesting what explanations if any they come up later in the month.

Just have to wait and see

“ At the top of every bubble, everyone is convinced it's not yet a bubble.”

-

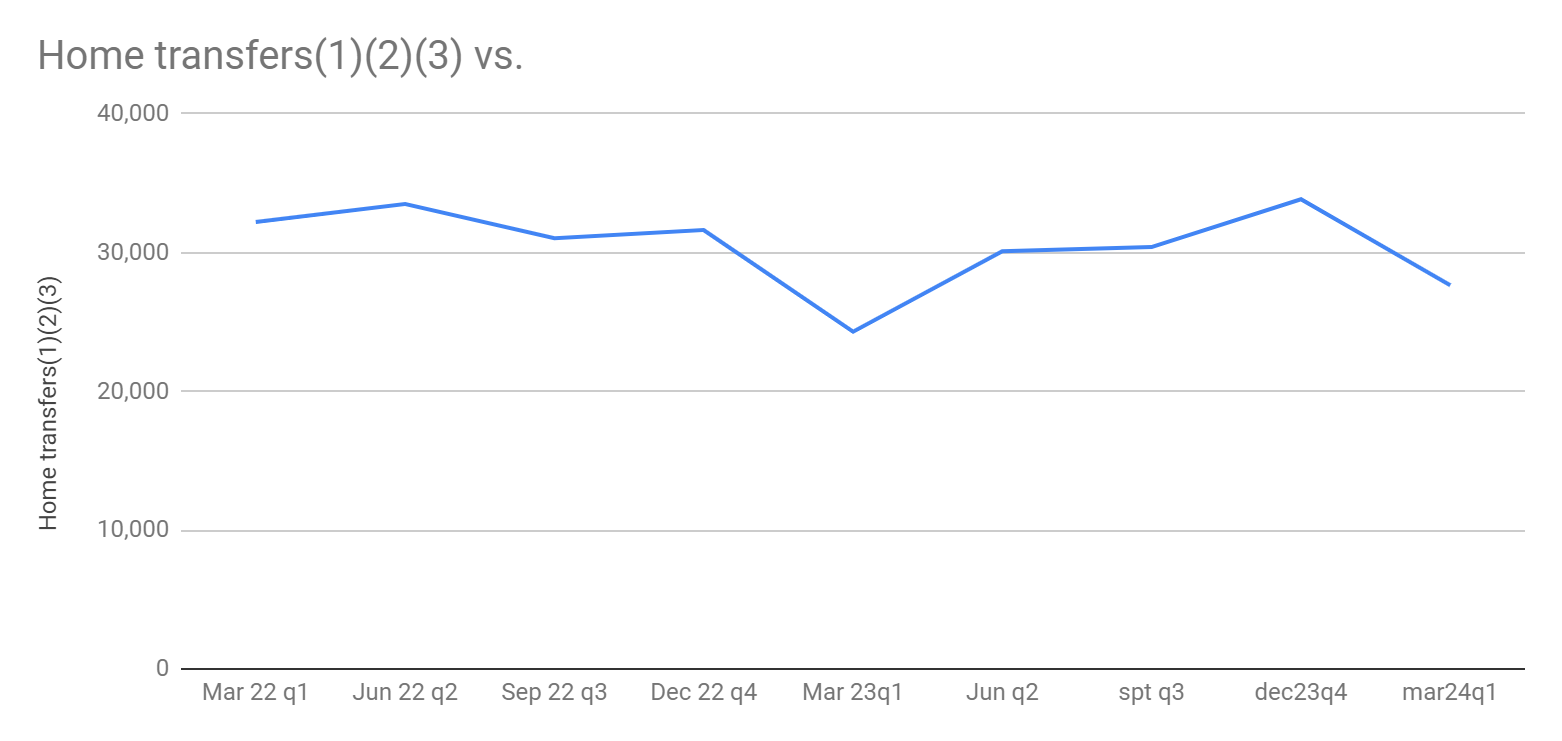

We are using the same NZ stat results . (to “ be on the same page Winner, I use the total home transfers on table 1 . The latest data is cell O-34.)

Here's a chart of these results over the last few years. I've tried other data but found this as good as any. I think the main thing is just to keep using a consistent set.

You can see on this chart what I'm seeing with the sharp drop of in Q1 24 home transfers.

-

Originally Posted by winner69

Hey Mav

If we looking at same data https://www.stats.govt.nz/informatio...-2024-quarter/. I’d say property market doing quite well. Last 2 qtrs (OCA H2) sales up 14% on pcp following +6% in the previous 2 quarters. NZIER reported volumes were up 5% and 22% on pcp.

Overall numbers 12 months March up 10%

OCA sales up 38% v pcp in H1 and only 3% in H2 ….the spike in H1 and the rumour that H223 sales May have been ‘managed’ has resulted in the sales trend looking lumpy eh….goodness knows what’s going on especially when ARV and SUM had strong 2nd half.

I can sort of see where you are coming from and it will be interesting what explanations if any they come up later in the month.

Just have to wait and see

I am very curious about your comment about "the spike in H1 and the rumour that H223 sales May have been ‘managed’".

The sales for HY1 24 are very high , in fact 38% of what I figure their unsold apartment stock was . This was more like the heady days of 2021 when they did actually sell stock at these rates.

I also note that the average apartment prices were quite low too. I put these 2 things down at the time to possible stock clearing of their harder to sell apartments and a sharper focus on sales. ( that was just a guess).

Are you willing to elaborate on the rumour comment?

Last edited by Maverick; Today at 06:17 PM.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks