-

25-09-2022, 10:38 AM

#13531

Member

Originally Posted by winner69

Comment elsewhere was an offer at $1 could see a deal being done as many punters would be happy to be put out of their misery …….

I'd be happy with $1 The other kids at school laughed at me when I bought mine at 76 cents. I'm the one laughing now.

-

25-09-2022, 11:53 AM

#13532

Originally Posted by winner69

Way share price going it could be the 80s soon.

NZD will probably fall more … Oceania an attractive takeover target?

Comment elsewhere was an offer at $1 could see a deal being done as many punters would be happy to be put out of their misery …….

Ridiculous …but one never knows what might happen

No way, I think any deal would be lucky to even go ahead at $1.50. I don't know who the commentators are, but they certainly are not existing shareholders. I think that such rumours are started by the actual takeover group so when they come up with their $1.25 offer everyone is relieved. It won't work.

Or start the rumour at $1.00, then buyer demand will disappear until the SP drops to 70 cents, when the shady group starts buying to get their foothold. This psychological manipulation with the SP is going on, it's akin to white collar crime.

Dont be fooled. OCA is a much stronger company than it is being credited by the current SP.

Last edited by bottomfeeder; 25-09-2022 at 11:59 AM.

-

25-09-2022, 02:51 PM

#13533

If I got a $1 offer I’d spit on it.

Min $1.35 and I’d feel robbed at that level! But then no more suffering

-

25-09-2022, 02:54 PM

#13534

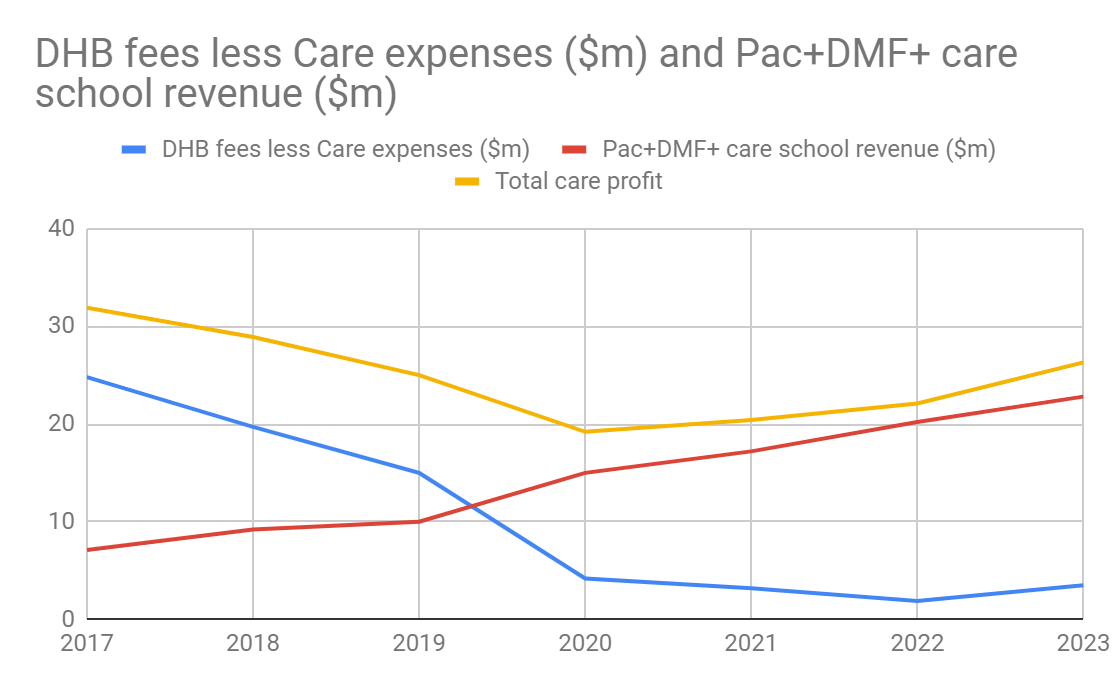

Over the last month or so I've started to breakdown why I'm very confident OCAs profit is about to strongly move upwards and onwards from here.

I suspect folk will be getting tired of my long posts about how good this company is while the entire world , other than a few on this forum, says it isn't ( ie. the SP). But let's carry on with a long weekend and get "care" out of the way.

To recap, the biggest driver of this profit increase , covered in post 13407, is the new build margins. We will see them increasing nicely and even more so as The Hell-yeah joins the list and the new build rate has also increased. The second profit increase driver is explained in post 13468, That's is essentially OCAs increase on embedded values that will also start flowing through as higher resale profits come in from higher resale prices.

Lets get onto the third ( of 5) driver , this is the difficult one that has caused so much grief on this forum ...Care profits.

A bit of background first…

OCA used to make reasonable care profit when they listed in 2017 but it has almost halved since then. The care side of the business certainly looks an abject failure on this measure. I think it is widely accepted that it's primarily caused by systematic reduction in Govt funding. It has also been repeatedly highlighted on this forum that “ rampant health care costs” have also largely contributed to the crashing profits. Also stated this will continue to consume any profit increases for many years yet. I strongly disagree on this second point but acknowledge it does look that way if one doesn't do quite intense investigation.

Understanding the reducing care profits beyond the basic numbers is a complicated task since OCA has listed and takes a lot of unpacking. It has been a conglomeration of layers of issues...

A. large numbers of bed decommissions ( one example is they removed 411 beds in one 6 month period alone in 2019- imagine all the considerations for cost/income distortions and what that does to the care profit).

B. Muddying of accounts with wage subsidy receipt and then a year later being fully repaid. A shortened 10 month year to change balance dates.

C. Covid effects of both lockdowns and direct costs.

D. Inefficiencies of care costs and staffing as the newly delivered care suites slowly fill up which takes a few years.

E. Inefficiencies of grandfathering original residents into the newly built care suites as their original premises now need to be demolished.

F. High wage rises.

G. Reducing Govt funding.

This list makes OCA care look pretty damned, however, there is now some good news;

A+E All “disruptive” bed decommissions and client grandfathering are now all but done and dusted.

B+C Also fully behind us now.

D, OCA have passed the inflection point (2020 as per chart below ) where their earlier deliveries are now optimizing at a rate that is offsetting the newer temporarily inefficient deliveries coming on stream. I understand there are only 2 recent deliveries now without a wait list. Note, of the deliveries are 100% full , some have grandfathered clients. This makes OCAs empty stock level look disastrous as grandfathered care suites are registered as “unsold”. ( A crucial point to understand- they are not empty.)

F+G. This does appear to be a massive and ongoing problem. The rest of this post is to help demonstrate why OCA have got a good handle on this and why it's all about to seemingly magically come right.

Here goes…

Govt funding has reduced over the years to now only leave a slither of profit for OCA ( as per the graph below) after expenses. It seems that the Govt people in white coats have decided how many “$ Jenga pieces” they can remove without collapsing the industry - well at least so far. They appear to have reached that low level 3 years ago.

BUT, IT HAS STABILIZED. Over the last 3 years OCA has now consistently only made about 2% of the $160m govt revenue to keep as profit after expenses.

To put this in perspective; OCA makes almost as much out of their “care training facility” now as they do looking after its entire NZ care operation of 2600 beds.

So OCA makes virtually nothing out of the Govt DHB fees after costs. The good news is that it has not gotten any worse for 3 years now. One has to make a slight mental adjustment that OCA spent an extra (non recurring as stated by Brent at the AGM) $2.5m on covid in 2022 which causes the slight dip on blue line on the chart below. I believe that the Govt knows they can not reduce their pay out any more without doors closing. They may have already gone too far which will need unwinding at some point. So that has put a floor on any more funding cuts. God knows how the 40% of NZ rest homes (those outside of the big 6 operators ) without care suits get by.

So as nurses etc have cost more recently , the Govt has also recently kept pace with their annual DHB rate rises, they even chucked in an extra surprise one off increase too. I believe they will continue to do so as what other choice do they have from here?

The good news for investors though is that for every dollar the Govt no longer supplies, OCA are now making almost as much by premium fees plus their training facility.

This year my 2023 forecast, included also on the chart below, says the almost linear increase in premium fees are just about at the point where they are going to exceed what has since been withheld from our good ol` kind Govt. Onwards and upwards from there.

One can generally say the government is now virtually only paying for all OCA care expenses and any actual profit now comes only from premium care charges, plus the school ( which is always flat around $1.5m) . The increase on extra charging , therefore profit, from here just keeps rising linearly.

As an aside….there is talk that OCA won't even bother the government for care fees at the Helier at all as their clients won't get the DHB subsidy anyway. IMO, its pretty cool when they can work their model to completely sidestep the govt as a business partner. Especially after the entire sector has been shafted so badly.- I digress.

It is also my opinion, that there are more risks to care profit to the upside as costs proportionality reduce slightly as efficiencies grow ( one example -OCA occupancy is only 92% while ARV achieves around 95%), borders opening to more labour and there's always a slight chance Govt has to increase funding at some stage as a crisis evolves - that will all be cream that OCA has learned to live without. These pleasant potential upsides are of course not in my workings.

Care profit is the most difficult part to untease about OCA and so I have tried to keep it brief. I said at the beginning that care profit is very difficult to unpack but here's the short cut method going forward…

(DHB fees x 2%) +PAC fees+DMF fees + $1.5m school profit +- one offs = care profit.

The only remaining key factors left to consider for OCAs overall underlying profit are;

1. the ever increasing village DMFs

2. Additional profit of the acquisitions after contributing for a full year

3. On the negative side, increased corporate + interest costs.

All of these remaining factors are pretty straight forward and

aren't particularly time consuming to put together. They can be for another day unless someone else wants to write them up.

So there you go folks, the five drivers of income are simultaneously rising, the key ones strongly. There will be some offset in increased corporate / interest expenses (discussed recently) but be assured that I've done plenty of work in that area and there's a lot left on the plate. The next 2 years especially are going to be very rewarding for those who have hung in this long, especially 2024

Here's the chart that will help it all make sense.( 2023 is my forecast) and why care is going to be ok.

Last edited by Maverick; 25-09-2022 at 03:41 PM.

-

25-09-2022, 02:58 PM

#13535

I'd be seriously pissed off if there was a takeover. I have faith in the company and nothing has changed for me in that regard. No "suffering" involved.

-

25-09-2022, 04:26 PM

#13536

Nice work Maverick. IMO realised gains on care suites should also be factored into the underlying profit for "Care". They currently sit in the village P&L. Such gains could not be made in the absence of the care model. I'm guessing they are not part of the "other" in your numbers? However, normally one needs to back out depreciation on care suites to be consistent with the OCA presentation, but I think they could be added together from a simplistic perspective.

Realised gains for care suites were:

FY17 $2.6m

FY18 $3.7m

FY19 $10.5m

FY20 $16.1m

FY21 $15.6m (10 months)

FY22 $15.6m

FY23: ?

-

25-09-2022, 07:01 PM

#13537

Originally Posted by Ferg

Nice work Maverick. IMO realised gains on care suites should also be factored into the underlying profit for "Care". They currently sit in the village P&L. Such gains could not be made in the absence of the care model. I'm guessing they are not part of the "other" in your numbers? However, normally one needs to back out depreciation on care suites to be consistent with the OCA presentation, but I think they could be added together from a simplistic perspective.

Hey Ferg,

My base model is laid out exactly as per their layout in the "investor presentation" - not "Annual report" which I'm guessing is the more correct layout that a man of your caliber would use.

So while , in principle ,I agree that care profit should actually read higher than it does when these extra earnings are included. But lets park that to the side for now and just work with how OCA present it for this conversation.

Accordingly the care suite resale gains are already accounted for in my second of this series under "embedded value" ( the one about profit is set to increase because of increased resale prices- this includes the care suites).

The same logic applies to depreciation. That they lump it all as just one number the end on the investor presentation.

I do know in the AR they charge this then give back that etc but that confuses the hell out of me. ( Basically care stuff depreciates faster than village stuff but itemizing all that makes the figures seem out of step compared with their peers so that's why they present it as one net number in the investor presentation - as you suggest, for simplicity.)

All I need to know is the overall final depreciation rate that comes off the underlying profit as long as it is consistent and predictable- which it is. So by doing this , it now seems in line with the other RV`s. ....You will know all this of course but if any one else is interested then it should help - or send them to sleep.

Last edited by Maverick; 25-09-2022 at 10:26 PM.

-

26-09-2022, 10:00 AM

#13538

Thanks for your post Maverick. As an aside….there is talk that OCA won't even bother the government for care fees at the Helier at all as their clients won't get the DHB subsidy anyway. IMO, its pretty cool when they can work their model to completely sidestep the govt as a business partner. Especially after the entire sector has been shafted so badly.- I digress

That would certainly be an interesting development. At the moment if residents are ineligible for a subsidy the rest homes still need to co-operate with government departments and private funding residents pay up to the maximum contribution as set by the MoH, with premium services charged additionally. I imagine if “exclusive” rest homes still wanted to offer their services, they would still need to registered and regularly examined by a government body.

‘Even at the Helier, I would imagine there could be a few residents, who had been long-time residents in the neighbourhood of the Eastern Bays, whose affairs are such, that they could be eligible for subsidies. Also some residents may have rich family assisting with the costs of purchasing an accommodation ORA, and would like access to the on-site rest home if needed..

Last edited by Bjauck; 26-09-2022 at 10:11 AM.

-

26-09-2022, 10:06 AM

#13539

Great post, Mav. Thanks for putting this together. Where is the reputation button when you need it?

I bookmarked this post and will use it as reference.

Anyway - I am glad that your view on the details shows the same picture as my high level view. Turning cr*ppy old sites in great locations into luxury care suites and sell them will first cost a lot of money (and this is what we have seen so far) and then make a lot of money (this is the bit coming now)."

Some of the posters here forget the most important trait of any investor: Patience! But hey, at the end of the day this site is called sharetrader, so this might be understandable  ; ;

Back to your post ... the blowing out of carer wages combined with a government philosophy which prefers to spend other peoples money (though, at the end, that's what every government does) did somewhat delay the process ... but you are absolutely right - they are clearly now scrapping along the bottom. Unless this (or the future government) wants to see care providers turning belly up in droves up like the salmon in NZK's much too warm waters ... they need to start to increase their care subsidies in step with the increased (often government generated) cost - right NOW.

Great post - cheers.

----

"Prediction is very difficult, especially about the future" (Niels Bohr)

-

26-09-2022, 10:07 AM

#13540

A future govt could embark on cost cutting - esp when health funding doesn't increase by more than CPI this subsidy will be at risk.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Bookmarks