-

01-02-2024, 02:41 PM

#18411

Originally Posted by SailorRob

Yes my agent also had the busiest January they can remember as have many others.

Why?

Appraisals and new listings.

The very opposite of what you might think when an agent says they are busy.

Driving from town to home - around 45 mins, there are more for sale signs up now than you could imagine, seems like more for sale than not for sale.

Nope this a reliable source and they were referring to buyers. That's what's unusual being January, buyers are normally on holiday no too interested.

But it's obviously just anecdotal.

Last edited by Daytr; 01-02-2024 at 03:03 PM.

-

01-02-2024, 03:05 PM

#18412

Originally Posted by winner69

But then guys like Jeff Bezos say ‘when the anecdotes and the data disagree, the anecdotes are usually right’

Another great saying from back in my trading days. " When the taxi drivers start a yellin, it's time to get a sellin. "

-

01-02-2024, 03:33 PM

#18413

Originally Posted by Daytr

Another great saying from back in my trading days. " When the taxi drivers start a yellin, it's time to get a sellin. "

I have a better saying "Sell when price>discounted future cash flows to perpetuity"

-

01-02-2024, 03:42 PM

#18414

Originally Posted by Maverick

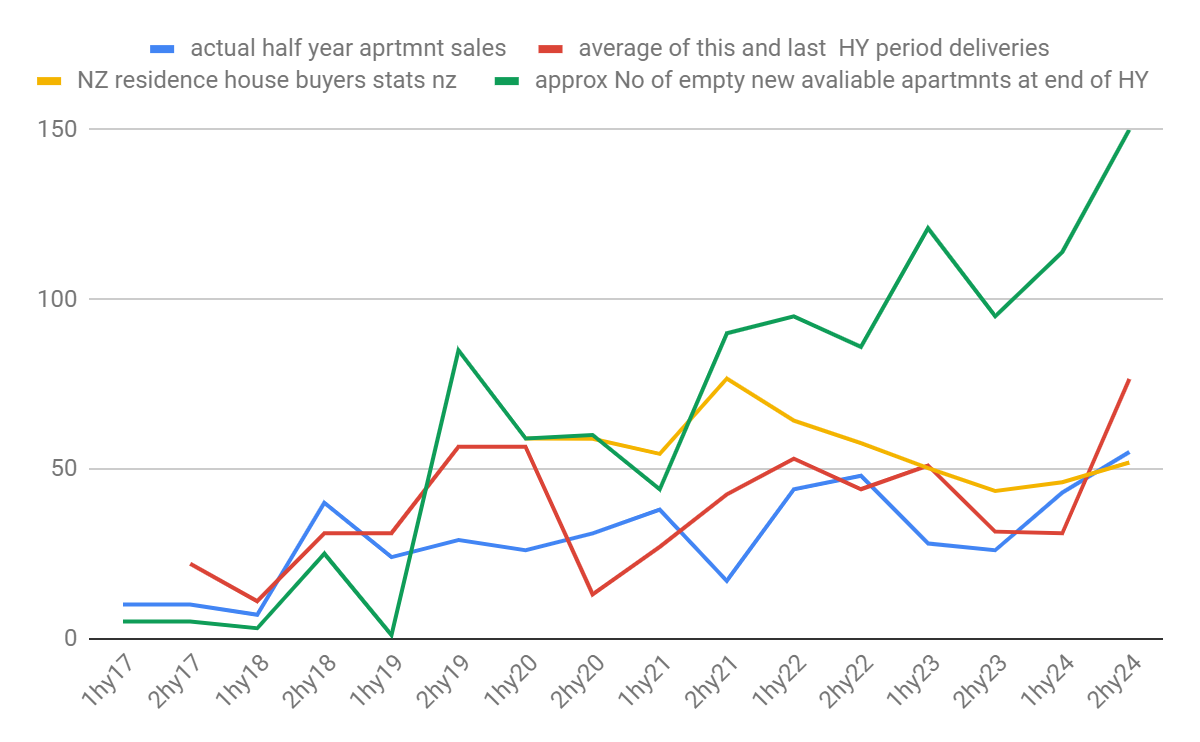

With all is chit chat on property market , here's a chart that most of you will find interesting.

It demonstrates many things but the original point of creating it was for me to see how the overall NZ housing sales may be affecting OCA`s ability to sell stock.

Notes on the data;

-This is only new apartments and does not include care suites, villas or resales.

-Housing sales data ( yellow line) comes from Stats NZ and to anticipate Q1 2024 I have simply doubled Q4 2023.( which came out this week)

- Housing sales stats have been multiplied by .001 to fit the graph nicely.

-I have averaged the deliveries ( red line) of the current HY period and previous HY. This both smooths the lumpy numbers a little and allows for OCAs enthusiasm to say something was delivered in a period when in fact occupation can be a little later into the next HY.

- I have anticipated 55 sales for this 2HY24.

-I started with an arbitrary 10 unsold apartments. This is a logical estimate but its accuracy doesn't matter too much as everything is relatively built from this starting point.

-The significant spike in current unsold stock is timing of large deliveries of Helier, Christchurch and Tauranga.

My takeaways ;

-There is definitely an accumulation of unsold stock through 2023CY when the NZ housing sales have slumped to their worst. I do not accept that apartments are not selling due to being unpopular or too expensive as in the past they did sell and the towers delivered pre 2021 are now all full with waiting lists.

- NZ stats say NZ housing sales have now increased 10% Q4 2023 from Q3 2023.

-The Helier is currently a large portion (50%) of available stock.

- It seems likely my expected 55 sales 2HY2024 is going to be light given the significant number of unsold stock and improving NZ sales. Using these data sets alone it could be more like 65 as posted earlier.

It is clear the powder keg of value OCA is now sitting on.

Either OCA can sell these down then everything gets real good, real soon ( balance sheets, cashflows P+L, downstream annuity income) … or if not …

then the model is disastrous.

Fortunately I am physically seeing first hand that sales are going very well and so I remain very confident it is the former.

As BaaBaa has said “ it's all about sales sales sales now”.

As all big property developers know its about cashflow cashflow.

sales to keep the lights on

one step ahead of the herd

-

01-02-2024, 04:20 PM

#18415

the helier not really going to produce meaningful cashflow for donkey years.

anyway test the lows again anyone ?

one step ahead of the herd

-

01-02-2024, 05:09 PM

#18416

Originally Posted by bull....

the helier not really going to produce meaningful cashflow for donkey years.

anyway test the lows again anyone ?

The gift that keeps on giving.

-

01-02-2024, 05:28 PM

#18417

Originally Posted by bull....

the helier not really going to produce meaningful cashflow for donkey years.

anyway test the lows again anyone ?

Why are saying that Bull? seriously , I'm keen to understand your point.

Its Helier that IS going to get the cashflow turned around. Brent said the updated sales numbers at the AGM , he also commented that it was selling faster than anticipated. And from what I have verified from visiting .Those comments and my numbers say it will all be sold within 1.5-2 years in this environment. That's all cashflow coming in instead of outflow as it has been.

Your comments dont line up with my observations and workings...?

-

01-02-2024, 06:12 PM

#18418

Originally Posted by Maverick

Your comments dont line up with my observations and workings...?

About which I am enormously glad.

-

01-02-2024, 06:50 PM

#18419

Originally Posted by ValueNZ

I have a better saying "Sell when price>discounted future cash flows to perpetuity"

Doesn't quite have the same ring to it....

-

01-02-2024, 07:07 PM

#18420

Originally Posted by Maverick

Why are saying that Bull? seriously , I'm keen to understand your point.

Its Helier that IS going to get the cashflow turned around. Brent said the updated sales numbers at the AGM , he also commented that it was selling faster than anticipated. And from what I have verified from visiting .Those comments and my numbers say it will all be sold within 1.5-2 years in this environment. That's all cashflow coming in instead of outflow as it has been.

Your comments dont line up with my observations and workings...?

Surely you don't take this fool seriously Mav!

The man that can make money from any chart anywhere anytime.

He's so full of it not even funny.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Bookmarks