-

10-04-2024, 01:18 PM

#19481

Originally Posted by Daytr

Nope that's just buying & selling.

Not arbitrage.

Anyway best of luck.

Yep, that is literally just buying and selling at a future point.

Worthless may as well say I can buy some BRK stock today and if ya think about it...when I sell 20 years later it is sorta like arbitrage in a way! he he he.

Just have to look at it the 'right way' dummies!!

-

10-04-2024, 03:42 PM

#19482

Thinking more about that arbitrage comment.

I can sort of see how these guys have landed in the doo doo here a bit.

It’s like when they took the insurance concept of float and have built a whole model around how resident loans are ‘kinda like float if ya really look at it in just the right way’.

When really it is not.

The majority of insurance customers pay their premiums for years, decades even and either never claim or claim very little. So all that money builds up and provided the cash coming in is, on average, higher than the money going out for the smaller number of clients who do claim …you have float. Lovely.

OCA first have to build a very expensive facility and then try to market and sell their units. Once they do sell a unit it is all but certain that they are going to have to pay a chunk of it back … either to the resident if they decide to move out or whatever is left of the loan to the beneficiaries once the resident kicks the bucket.

It’s not even remotely comparable to insurance float.

But by Christ these guys have latched onto this as though it is real and sit here year in, year out scratching their balls wondering why Mr Market just doesn’t ’get it’ 🤭

-

10-04-2024, 04:25 PM

#19483

MistaTea wrote

''Once they do sell a unit it is all but certain that they are going to have to pay a chunk of it back … either to the resident if they decide to move out or whatever is left of the loan to the beneficiaries once the resident kicks the bucket.''

Yes, but they don't have to pay that chunk of it back until they have resold the unit to new resident (at a higher price). That's the concept of the float

Last edited by Poet; 10-04-2024 at 04:26 PM.

-

10-04-2024, 04:30 PM

#19484

Originally Posted by mistaTea

Thinking more about that arbitrage comment.

I can sort of see how these guys have landed in the doo doo here a bit.

It’s like when they took the insurance concept of float and have built a whole model around how resident loans are ‘kinda like float if ya really look at it in just the right way’.

When really it is not.

The majority of insurance customers pay their premiums for years, decades even and either never claim or claim very little. So all that money builds up and provided the cash coming in is, on average, higher than the money going out for the smaller number of clients who do claim …you have float. Lovely.

OCA first have to build a very expensive facility and then try to market and sell their units. Once they do sell a unit it is all but certain that they are going to have to pay a chunk of it back … either to the resident if they decide to move out or whatever is left of the loan to the beneficiaries once the resident kicks the bucket.

It’s not even remotely comparable to insurance float.

But by Christ these guys have latched onto this as though it is real and sit here year in, year out scratching their balls wondering why Mr Market just doesn’t ’get it’ 來

I found this report recently by a guy by the name of Geoff Gannon, he is pretty small but listening to his podcasts seems very intelligent, and has outperformed the market.

https://focusedcompounding.com/summe...er-with-float/

Thesis Point 2: Float

- Operators in the retirement village industry generate costless float with every sales cycle which they can use to fund new developments without using large amounts of equity. This is especially effective when there is already a large, mature base that can generate the float to fund newer developments

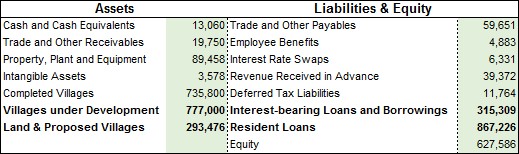

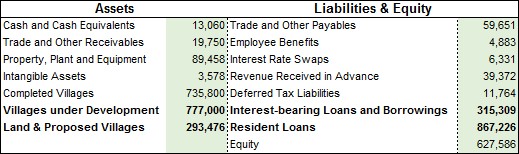

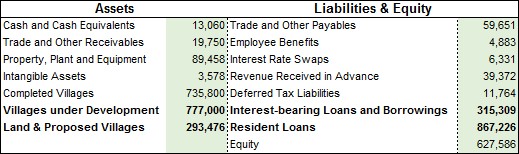

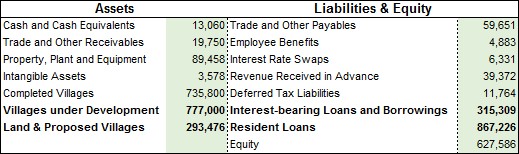

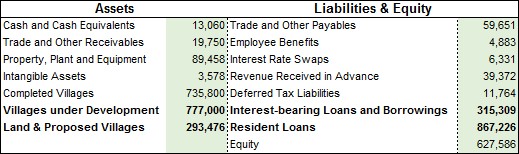

- The float is booked as a liability called “Resident Loans” on the balance sheet. By selling what are effectively timeshares in retirement units, developers can finance over 80% of capital for new property developments at zero interest rates. At the same time, the DMF portion pays for ongoing operating costs at existing villages

- A look at the balance sheet confirms that $735MM in completed villages are currently generating $867MM in resident loan float. Summerset is borrowing an additional $315MM from banks to build out $777MM in additional retirement villages currently under development as well as a $293MM Landbank for future propsed villages. The astute reader will note that the $ value of properties under development is currently larger than the $ value of completed villages

- As shown in Thesis Point 1, the development of new villages is generating a ~4% ROA per annum through development margins. If, at some point Summerset stopped growing, it could invest its float into bonds and probably generate a similar ROA. At this point, growing the float by building out further retirement villages is, however, more value accretive

-

10-04-2024, 04:57 PM

#19485

Originally Posted by ValueNZ

I found this report recently by a guy by the name of Geoff Gannon, he is pretty small but listening to his podcasts seems very intelligent, and has outperformed the market.

https://focusedcompounding.com/summe...er-with-float/

Thesis Point 2: Float- Operators in the retirement village industry generate costless float with every sales cycle which they can use to fund new developments without using large amounts of equity. This is especially effective when there is already a large, mature base that can generate the float to fund newer developments

- The float is booked as a liability called “Resident Loans” on the balance sheet. By selling what are effectively timeshares in retirement units, developers can finance over 80% of capital for new property developments at zero interest rates. At the same time, the DMF portion pays for ongoing operating costs at existing villages

- A look at the balance sheet confirms that $735MM in completed villages are currently generating $867MM in resident loan float. Summerset is borrowing an additional $315MM from banks to build out $777MM in additional retirement villages currently under development as well as a $293MM Landbank for future propsed villages. The astute reader will note that the $ value of properties under development is currently larger than the $ value of completed villages

- As shown in Thesis Point 1, the development of new villages is generating a ~4% ROA per annum through development margins. If, at some point Summerset stopped growing, it could invest its float into bonds and probably generate a similar ROA. At this point, growing the float by building out further retirement villages is, however, more value accretive

I’m just stoked you didn’t really block me honey!

Geoff must use ST as his main analysis source.

-

10-04-2024, 05:09 PM

#19486

Originally Posted by ValueNZ

I found this report recently by a guy by the name of Geoff Gannon, he is pretty small but listening to his podcasts seems very intelligent, and has outperformed the market.

https://focusedcompounding.com/summe...er-with-float/

Thesis Point 2: Float- Operators in the retirement village industry generate costless float with every sales cycle which they can use to fund new developments without using large amounts of equity. This is especially effective when there is already a large, mature base that can generate the float to fund newer developments

- The float is booked as a liability called “Resident Loans” on the balance sheet. By selling what are effectively timeshares in retirement units, developers can finance over 80% of capital for new property developments at zero interest rates. At the same time, the DMF portion pays for ongoing operating costs at existing villages

- A look at the balance sheet confirms that $735MM in completed villages are currently generating $867MM in resident loan float. Summerset is borrowing an additional $315MM from banks to build out $777MM in additional retirement villages currently under development as well as a $293MM Landbank for future propsed villages. The astute reader will note that the $ value of properties under development is currently larger than the $ value of completed villages

- As shown in Thesis Point 1, the development of new villages is generating a ~4% ROA per annum through development margins. If, at some point Summerset stopped growing, it could invest its float into bonds and probably generate a similar ROA. At this point, growing the float by building out further retirement villages is, however, more value accretive

As the whole float thing doesn’t quite pass the sniff test, I asked my ‘personal consultant’ to review that 21 page document for me and comment on the idea of ‘float’ in the retirement village context.

Come on, you gotta admit this is fun?

****

Geoff Gannon's application of the 'float' concept to the retirement village sector, particularly in the case of Summerset, is innovative and presents an interesting financial perspective. However, there are critical points and nuances that suggest this might not be a precise or fully applicable comparison to the traditional understanding of 'float'. Here's why the analogy may be considered incorrect or overly simplistic:

1. **Nature of 'Float'**: In its most common financial context, particularly in insurance, 'float' refers to money collected from premiums before claims are paid out. This money can be invested for the benefit of the insurer during the interim. The critical aspect is that this money is, theoretically, not the company's but will be used to cover future claims. In contrast, the money collected from residents in retirement villages, while it does serve as upfront capital (akin to interest-free loans), represents a contractual obligation to provide housing and services, not to cover claims or losses. This fundamental difference in the nature of obligations makes the retirement village 'float' conceptually different from insurance float.

2. **Risk Profile**: The risks associated with managing 'float' in insurance are significantly different from those in operating a retirement village. Insurers use the 'float' to make investments that can cover the future claims and still generate profit. For retirement villages, the collected funds (considered 'float') are primarily used for development and operational costs. The risk of real estate market fluctuations and the demographic shifts affecting demand for retirement villages do not parallel the insurance industry's investment and claim risks

3. **Return and Utilization**: Insurance companies can invest 'float' in a wide range of assets, aiming for returns that exceed their claims and operational expenses. For retirement villages, the use of funds is more restricted, primarily funneling into real estate and operational services. This limitation impacts the potential for generating additional income from these funds, unlike 'float' in the insurance sector, where investments can lead to significant profits beyond the core business model.

4. **Accounting and Financial Implications**: 'Float' in insurance is an understood and accepted financial concept with clear accounting practices for handling these funds. Applying the 'float' concept to retirement villages introduces complexity into financial statements, as these funds must be accounted for differently, reflecting obligations to residents rather than potential claims payouts. This complexity could lead to challenges in financial analysis and valuation.

5. **Regulatory Environment**: The regulatory oversight for insurance companies managing 'float' is stringent, with specific requirements for reserves to ensure claims can be paid. The regulatory environment for retirement villages, while also stringent, operates under different principles, focusing on consumer protection and quality of service rather than financial solvency related to claims payouts. This difference highlights another area where the analogy between insurance 'float' and retirement village funds breaks down.

In conclusion, while the comparison can offer interesting insights into the financial management of retirement villages, the fundamental differences in obligation nature, risk profile, utilisation of funds, and regulatory considerations suggest that equating retirement village funds to 'float' in the traditional sense may not be entirely accurate or appropriate.

-

10-04-2024, 08:28 PM

#19487

Originally Posted by mistaTea

As the whole float thing doesn’t quite pass the sniff test, I asked my ‘personal consultant’ to review that 21 page document for me and comment on the idea of ‘float’ in the retirement village context.

Come on, you gotta admit this is fun?

****

Geoff Gannon's application of the 'float' concept to the retirement village sector, particularly in the case of Summerset, is innovative and presents an interesting financial perspective. However, there are critical points and nuances that suggest this might not be a precise or fully applicable comparison to the traditional understanding of 'float'. Here's why the analogy may be considered incorrect or overly simplistic:

1. **Nature of 'Float'**: In its most common financial context, particularly in insurance, 'float' refers to money collected from premiums before claims are paid out. This money can be invested for the benefit of the insurer during the interim. The critical aspect is that this money is, theoretically, not the company's but will be used to cover future claims. In contrast, the money collected from residents in retirement villages, while it does serve as upfront capital (akin to interest-free loans), represents a contractual obligation to provide housing and services, not to cover claims or losses. This fundamental difference in the nature of obligations makes the retirement village 'float' conceptually different from insurance float.

2. **Risk Profile**: The risks associated with managing 'float' in insurance are significantly different from those in operating a retirement village. Insurers use the 'float' to make investments that can cover the future claims and still generate profit. For retirement villages, the collected funds (considered 'float') are primarily used for development and operational costs. The risk of real estate market fluctuations and the demographic shifts affecting demand for retirement villages do not parallel the insurance industry's investment and claim risks

3. **Return and Utilization**: Insurance companies can invest 'float' in a wide range of assets, aiming for returns that exceed their claims and operational expenses. For retirement villages, the use of funds is more restricted, primarily funneling into real estate and operational services. This limitation impacts the potential for generating additional income from these funds, unlike 'float' in the insurance sector, where investments can lead to significant profits beyond the core business model.

4. **Accounting and Financial Implications**: 'Float' in insurance is an understood and accepted financial concept with clear accounting practices for handling these funds. Applying the 'float' concept to retirement villages introduces complexity into financial statements, as these funds must be accounted for differently, reflecting obligations to residents rather than potential claims payouts. This complexity could lead to challenges in financial analysis and valuation.

5. **Regulatory Environment**: The regulatory oversight for insurance companies managing 'float' is stringent, with specific requirements for reserves to ensure claims can be paid. The regulatory environment for retirement villages, while also stringent, operates under different principles, focusing on consumer protection and quality of service rather than financial solvency related to claims payouts. This difference highlights another area where the analogy between insurance 'float' and retirement village funds breaks down.

In conclusion, while the comparison can offer interesting insights into the financial management of retirement villages, the fundamental differences in obligation nature, risk profile, utilisation of funds, and regulatory considerations suggest that equating retirement village funds to 'float' in the traditional sense may not be entirely accurate or appropriate.

Did SkyTV pass the sniff test?

You're right that OCA's float is not like insurance float, it's actually far superior.

-

10-04-2024, 08:37 PM

#19488

Originally Posted by ValueNZ

You're right that OCA's float is not like insurance float, it's actually far superior.

He's not right, it's his AI that is right. The RV float (which even the AI acknowledges does exist) only has similarities to Insurance floats. It was a useful analogy though that SR raised, to get people thinking about how these RV's fund their development and sustain their growth, however it appears on the balance sheet.

-

10-04-2024, 09:27 PM

#19489

Member

I am afraid to say it as well mistaTea but I find the AI posts neither fun nor interesting. I do think all members should refrain from copying and pasting AI output here.

Regarding the float concept, I suspect there is something in it.

The fact that the amount paid back when a resident leaves is replenished by the subsequent resident means for every unit we basically have its full value in cash on hand at any time. It is an interest free loan we have to repay that we can repay by just taking out another interest free loan. We perpetually have someone else's money at our disposal, which can be used to our benefit. If things are going well each subsequent loan is also bigger than the last one. After many cycles we end up with far more loaned from residents than we ever had cash initially that set the ball rolling.

I have seen a lot of flak thrown at Sailor around this but I think most of that was really due to his personality. I have yet to see a particularly convincing take-down of the float concept that triggers an 'aha' moment for me, but certainly would like to see both sides of the argument properly. What am I missing?

There are potential concerns with it that might stop it working as well as Sailor made it sound.

The DMF being adequate enough to cover expenses or not makes a big difference to the equation.

The growth engine here is also quite tied to selling the unit for more to the next resident than we did for the last one. The less this happens, the less potent the cycle is of course.

The ability to actually sell units quickly is critical, as is getting the replenishing renewals in quickly. If the stream of new residents coming in is disrupted or not as forthcoming as expected, then the cycle can breakdown. In the worst case the liability could become a big problem. I suspect the covid lows were reflecting this disaster possibility.

-

11-04-2024, 07:00 PM

#19490

Originally Posted by ValueNZ

I found this report recently by a guy by the name of Geoff Gannon, he is pretty small but listening to his podcasts seems very intelligent, and has outperformed the market.

https://focusedcompounding.com/summe...er-with-float/

Thesis Point 2: Float- Operators in the retirement village industry generate costless float with every sales cycle which they can use to fund new developments without using large amounts of equity. This is especially effective when there is already a large, mature base that can generate the float to fund newer developments

- The float is booked as a liability called “Resident Loans” on the balance sheet. By selling what are effectively timeshares in retirement units, developers can finance over 80% of capital for new property developments at zero interest rates. At the same time, the DMF portion pays for ongoing operating costs at existing villages

- A look at the balance sheet confirms that $735MM in completed villages are currently generating $867MM in resident loan float. Summerset is borrowing an additional $315MM from banks to build out $777MM in additional retirement villages currently under development as well as a $293MM Landbank for future propsed villages. The astute reader will note that the $ value of properties under development is currently larger than the $ value of completed villages

- As shown in Thesis Point 1, the development of new villages is generating a ~4% ROA per annum through development margins. If, at some point Summerset stopped growing, it could invest its float into bonds and probably generate a similar ROA. At this point, growing the float by building out further retirement villages is, however, more value accretive

Or simply put, they raise capital, use that capital to build units, sell the units & use the proceeds & debt to build more units, rinse & repeat.

Pretty standard developer practice, or any business really, who sells widgets to buy & sell more widgets.

No magic float.

Even SailorBoy finally agreed the 'float' doesn't even-tempered until they stop building and build a pile of cash from the DMF on resales.

Hopefully you find my posts helpful, but in no way should they be construed as advice. Make your own decision.

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

|

|

Reply With Quote

Reply With Quote

Bookmarks